The Goods and Services Tax (GST) system is devised in such a way that it presents businesses with a useful mechanism known as Input Tax Credit (ITC). In other words, ITC is a way businesses become eligible to get credit on the GST they have paid on their purchases.

You can balance this credit against the GST collected from sales transactions. Thus, ITC helps reduce the overall GST liability that the business incurs at the time of sales.

It also ensures businesses avoid double taxation by allowing them to reclaim the GST paid on inputs. As a result, they only have to pay the net GST amount on transactions related to their final sales.

Also Read: What are the Requirements for claiming ITC on Imported goods?

Also Read: What are the Requirements for claiming ITC on Imported goods?

Source1: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Source 2: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Apart from the above-mentioned items, there are various other goods and services for which businesses can not claim for ITC. They are-

Source1: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Source 2: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Apart from the above-mentioned items, there are various other goods and services for which businesses can not claim for ITC. They are-

ITC Eligibility for Specific Marketing Expenses

Businesses should accustom themselves to the requirements mandated in the GST laws to find out whether they can meet the criteria for claiming ITC on their marketing expenses. Additionally, the legal framework of the Goods and Services Tax (GST) permits you to claim ITC on specific marketing promotion expenses. So, what do you have to keep in mind about marketing expenses before you claim ITC?-

Commercial Use:

-

Nature of Marketing Expenses and ‘Inputs’:

-

Goods Specifically Used for Marketing and Promotional Schemes:

-

Complying with the GST Laws:

- Businesses cannot claim ITC on costs incurred for food and beverages unless they provide the food items to employees.

- All costs incurred while making political contributions, donations, employee welfare expenses, entertainment expenses or paying penalties and fines will not be considered eligible for claiming ITC.

GST Credit on Advertising Costs Examples

Marketing is advertising or promoting one’s goods or services to increase the sales of the business. Moreover, the GST, which applies to advertising costs, provides an opportunity for businesses to claim ITC on advertising-related expenses. Businesses might be able to avail ITC on costs which can be related to advertising under specific situations. A few examples of marketing and advertising expenses on which businesses can claim GST credit are--

Advertising services

-

Print Advertising

-

Digital Advertising

Claiming ITC on promotional events

Businesses should bear in mind that the distribution of promotional items has to be made in accordance with the specified contractual obligations. Here are a few examples of promotional items for which businesses can claim ITC:-

Promotional Events:

-

Promotional Materials:

-

Combo offers:

-

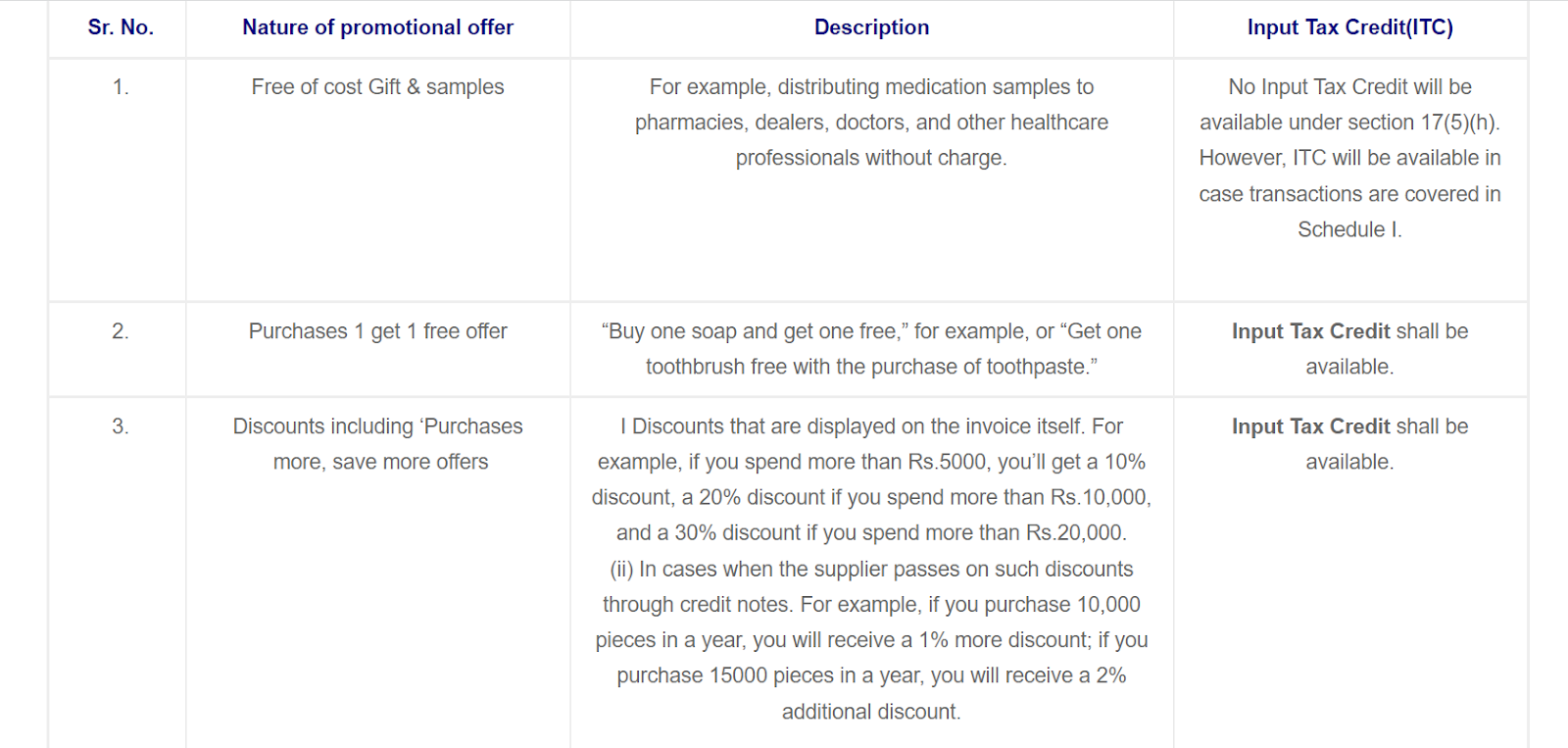

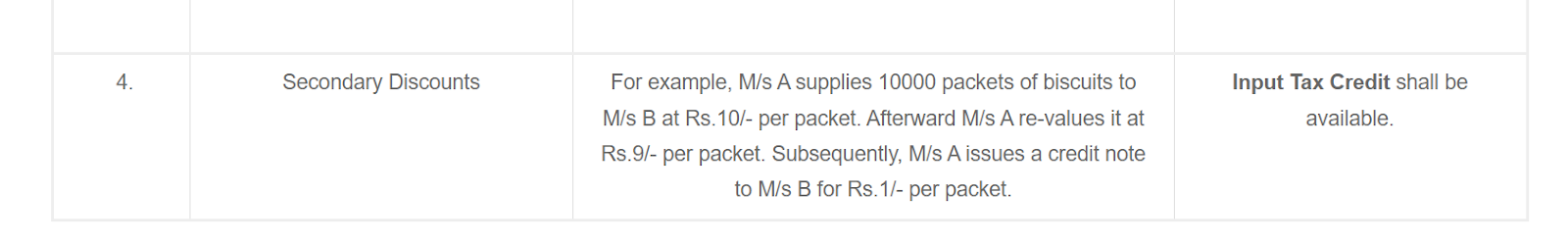

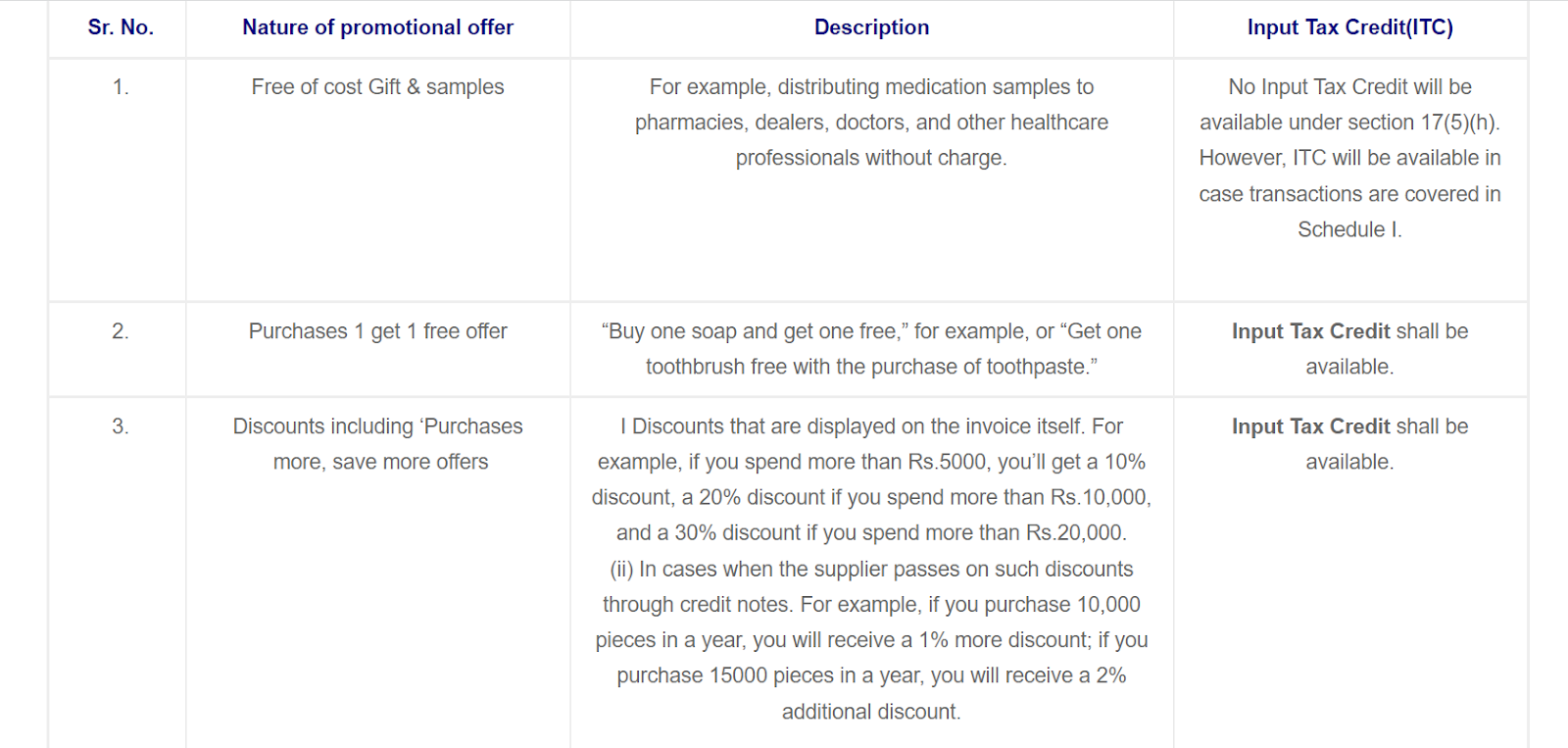

Sales Promotional schemes:

Documenting ITC for sponsored activities

Sponsorship activities include activities wherein one party supports another with money or other assistance in exchange for promotion. This support can be by way of funds, goods, or services. While the GST rate for sporting events is typically 18%, for cultural or artistic events, it may be lower at 12%. For documenting ITC for sponsored activities, it is important to understand the legal framework that supports the claiming of ITC as well as the nexus between Sponsorship and GST.-

GST and Sponsorship:

-

Effect on Service Receiver:

-

Effect on Service Provider:

-

ITC Reversal:

-

CSR Activities and ITC:

Approved marketing expenses for ITC claims

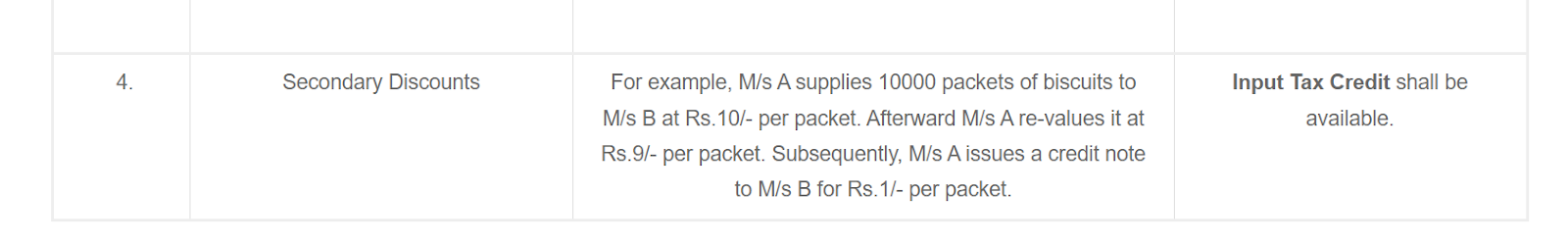

The following tables will help one get an idea of whether ITC can be claimed on a specific marketing expense.Items on which ITC can be claimed:

Also Read: What are the Requirements for claiming ITC on Imported goods?

Also Read: What are the Requirements for claiming ITC on Imported goods?

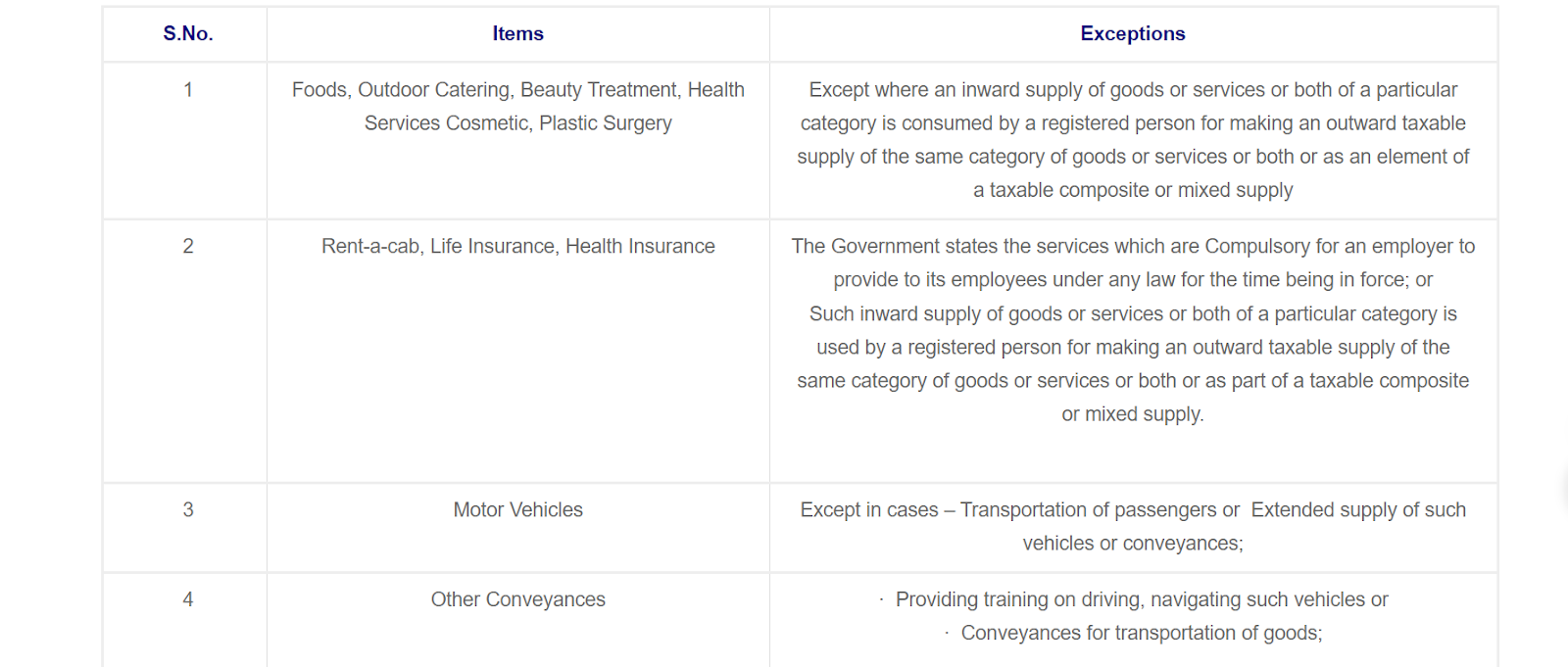

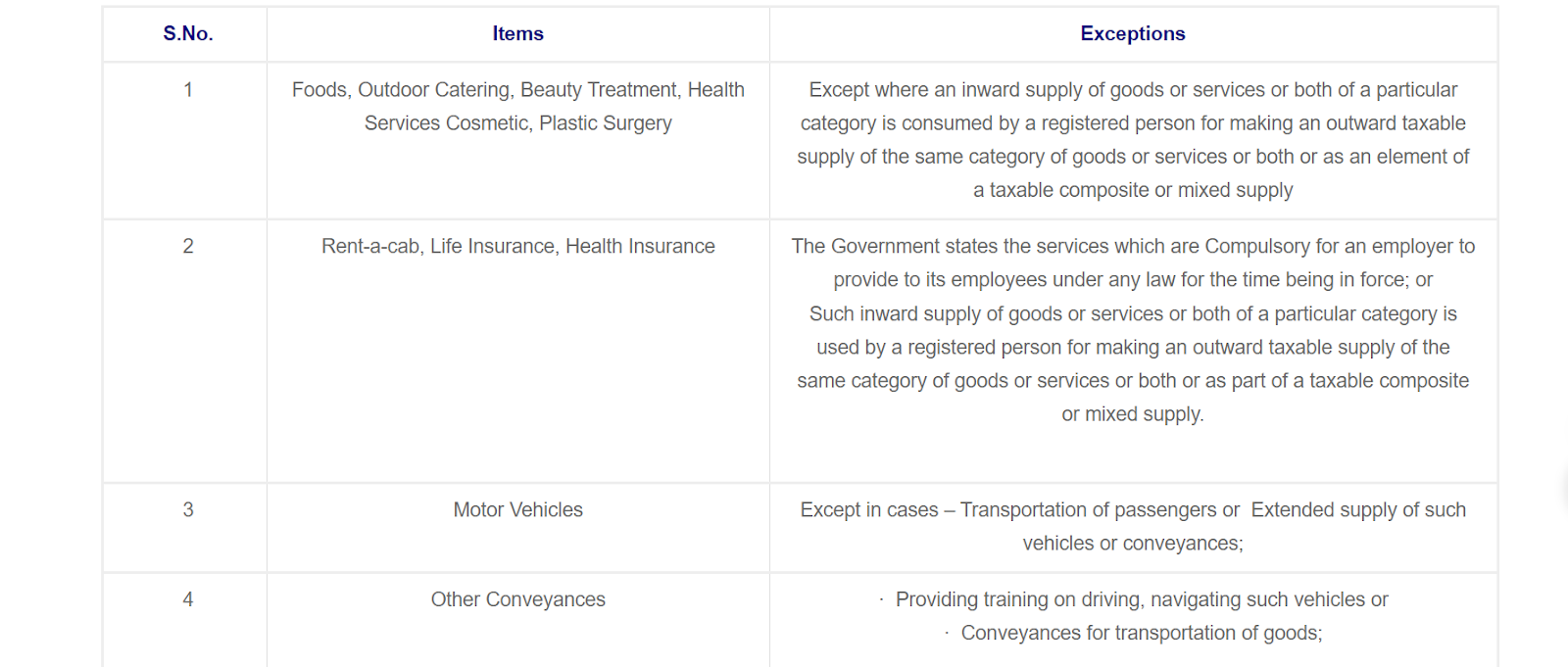

Certain items on which ITC can not be claimed:

Source1: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Source 2: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Apart from the above-mentioned items, there are various other goods and services for which businesses can not claim for ITC. They are-

Source1: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Source 2: https://carajput.com/blog/itc-on-marketing-expense-sales-promotional-schemes/amp/

Apart from the above-mentioned items, there are various other goods and services for which businesses can not claim for ITC. They are-

- Club memberships

- Health centre memberships

- Home travel concession benefits

- Written-off goods

- Vacation travel benefits provided to employees

- Stolen goods

- Goods given away as gifts

- Free samples

- Goods or services used for personal consumption

- Lost goods

- Destroyed goods

- Fitness centre memberships

Maximising GST benefits for promotional spending

In order to maximise GST benefits for promotional spending, businesses have not just to optimise ITC but also minimise their tax liabilities. Here are a few strategies that can help organisations maximise GST benefits--

Through Free Samples:

-

Through Promotional Quantity Offers:

-

Through Cashback Coupons and Promotional Gift Vouchers:

-

Through Promotional Giveaways:

Conclusion

Businesses should have a proper understanding of ITC eligibility for specific marketing expenses, including advertising costs and promotional events, to maximise GST benefits. By enhancing GST compliance as well as proper documentation of ITC for sponsored activities and approved marketing expenses, businesses will be able to make the most out of the Input Tax Credit. Also Listen: CaptainBiz Ke Sath Apne Reports Ko Generate KareinFrequently Asked Questions (FAQs)

-

What is Input Tax Credit (ITC)?

-

Can businesses claim ITC on GST paid on personal costs?

-

Can ITC be claimed on goods distributed as complimentary gifts?

-

Is ITC allowed on advertising-related expenses?

-

What is the GST rate for print media and digital media?

While it is 5% for print media, the rate of GST for digital media is 18%.

-

On what promotional events can ITC be claimed?

-

What is Reverse Charge Mechanism (RCM)?

-

Can businesses claim ITC on CSR activities?

-

What is ITC Reversal?

-

Are businesses eligible to claim ITC on goods distributed as free samples?

Claim smarter — explore eligible marketing expenses for ITC with CaptainBiz.

CaptainBiz Billing & Inventory Software tracks every Input Tax Credit with precision.

Register Now

Ateet Sharma

Freelance Content Writer

Ateet Sharma is a B.com graduate and has done an MBA in Finance. He has worked majorly in the banking sector for more than 5 years. He has worked for retail banking as well as credit analysis and has worked for banking brands like Axis Bank, DHFL, Capital First, Bajaj Finance etc. He has written articles on varied topics in finance like banking, taxation, insurance, stock markets etc. Ateet likes to listen to music and read books in his free time.