India recorded impressive GST collections in May 2025 which showed that the country’s economy has improved and enforced new compliance measures well. GST is an extensive indirect tax levied on the sale and consumption of goods and services in the concerned country apart from acting as a good source of government revenue. This paper seeks to establish the trends of GST collection during the fiscal month of May 2025 about the current collected amount and gives some predictions and factors affecting the current trend.

These trends enable people to understand how businesses are operating, the efficiency of the government- tax plans for it, and what we are likely to expect in the following months. Such patterns would help the policy makers to analyze how the economic activities affected the GST collections in the same way, and decide in advance the probable future growth of GST collections in India.

For the fiscal May in 2025, India’s gross Goods and Services Tax (GST) collections totaled ₹1. 73 lakh crore. This is fixed to a 10% year on year through a significant rise of domestic transactions by 15%. 3% and moderation of imports by 4. 3%. Even after the refunds, the total receipts collected in May 2025 towards the GST amounted to ₹1. 44 lakh crore, reflected a growth of six. The banking sector also experienced a tremendous growth of 43 lakh crore.

For the fiscal May in 2025, India’s gross Goods and Services Tax (GST) collections totaled ₹1. 73 lakh crore. This is fixed to a 10% year on year through a significant rise of domestic transactions by 15%. 3% and moderation of imports by 4. 3%. Even after the refunds, the total receipts collected in May 2025 towards the GST amounted to ₹1. 44 lakh crore, reflected a growth of six. The banking sector also experienced a tremendous growth of 43 lakh crore.

Factors Contributing to the Growth in GST Collection

-

Economic Recovery

-

Improved Tax Compliance

-

Digital Transformation

GST Collections of May 2025

For the fiscal May in 2025, India’s gross Goods and Services Tax (GST) collections totaled ₹1. 73 lakh crore. This is fixed to a 10% year on year through a significant rise of domestic transactions by 15%. 3% and moderation of imports by 4. 3%. Even after the refunds, the total receipts collected in May 2025 towards the GST amounted to ₹1. 44 lakh crore, reflected a growth of six. The banking sector also experienced a tremendous growth of 43 lakh crore.

For the fiscal May in 2025, India’s gross Goods and Services Tax (GST) collections totaled ₹1. 73 lakh crore. This is fixed to a 10% year on year through a significant rise of domestic transactions by 15%. 3% and moderation of imports by 4. 3%. Even after the refunds, the total receipts collected in May 2025 towards the GST amounted to ₹1. 44 lakh crore, reflected a growth of six. The banking sector also experienced a tremendous growth of 43 lakh crore.

Breakdown of May 2025 Collections:

- Central Goods and Services Tax (CGST): ₹32,409 crore;

- State Goods and Services Tax (SGST): ₹40,265 crore;

- Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

- Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

Breakdown of collections in the FY 2025-26 Till May 2025

- Central Goods and Services Tax (CGST): ₹76,255 crore;

- State Goods and Services Tax (SGST): ₹93,804 crore;

- Integrated Goods and Services Tax (IGST): ₹1,87,404 crore, including ₹77,706 crore collected on imported goods;

- Cess: ₹25,544 crore, including ₹2,084 crore collected on imported goods.

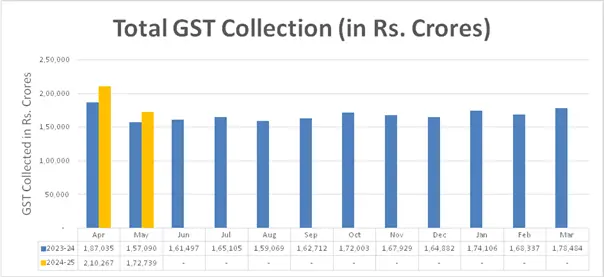

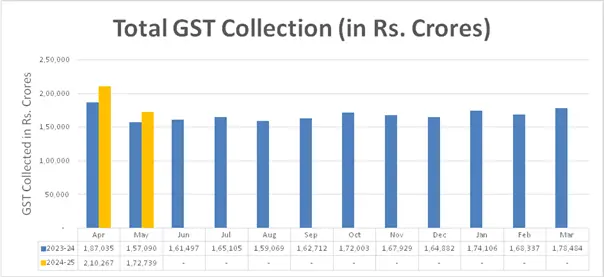

Inter-Governmental Settlement

The Central Government supported ₹38,519 crore to CGST and ₹32,733 crore to SGST in t May, 2025, out of total net IGST collected ₹67,204 crore. This would mean that CGST would gross ₹70,928 crore and SGST ₹72,999 crore in May, 2025 on gross basis but net of regular settlement. Likewise in the FY 2025–26 up to May this year the central government released ₹ 88,827 crore to CGST and ₹ 74,333 crore to SGST from the net IGST collection of ₹ 154,671 crore. As a result, the total collection of CGST will be ₹1,65,081 crore and that of SGST will be ₹ 1,68,137 crore calendar year wise in FY 2025-26 up to the month of May on regular basis after adjustment. The chart below shows trends in monthly gross GST revenues during the current year.

| Category | Details |

| Total Collection | Significant increase observed in overall GST collection. |

| Year-on-Year Growth | Noticeable growth compared to the same month in the previous year. |

| Month-on-Month Growth | Positive growth trend observed compared to the previous month. |

| Component Breakdown | Includes contributions from CGST, SGST, IGST, and Cess components. |

| Sector-wise Collection | Major contributions from manufacturing, services, retail, real estate, and other sectors. |

| State-wise Collection | High collections reported in key states like Maharashtra, Karnataka, Tamil Nadu, Gujarat, and Uttar Pradesh. |

| Trends Observed | Improved compliance, Economic recovery and Increase in digital transactions |

| Future Projections | Ambitious targets for the next fiscal year Continued focus on compliance and simplification and Expected sectoral growth in manufacturing and services |

Current Trends and Challenges

-

Shifting Economic Dynamics

-

Legislative Amendments

-

Technological Advancements

Strategic Considerations for Businesses

-

Proactive Compliance Measures

-

Optimal Tax Planning Strategies

-

Embracing Digital Transformation

Conclusion

The latest GST collection in May of 2025 reveals several trends and perspectives worth discussing. They further pointed out that the steady rise in GST revenue indicates an incremental recovery in economic activities in course of time buoyed by the government’s stimulus and policy measures. The study shows that the GST is a well-received tax as e-commerce, digitized services, and essential commodities have formed the significant portion of the amounts collected. This is clearly a change in the pattern of consumption and growing influence of technology in facilitating economic activities.FAQ

-

What major trends are determining the May 2025 GST collection prospects?

-

How the Legislative Amendments Affect GST Collections in May 2025?

-

What are the major challenges encountered by businesses in May 2025 in adhering to the processes for GST compliance?

-

what is the favorable role of technology in the context of enhancing the strict processes of GST collection?

-

What ways can the use of data analytics for GST collection work for businesses in the analysis illustrated in the context of May 2025?

-

How international trade treaties affect the collection of GST in May 2025?

-

What extent is that GST collection useful for government revenue and fiscal policy in the month of May 2025?

-

What Parties can do to maximize their tax compliance?

-

What ways can businesses receive information on the new and emerging trend in GST collections and legalities in May 2025?

-

How may the market situation in terms of GST collection by May 2025 affect SMEs and startup firms?

Analyze GST performance in May 2024 – plan smarter with key projections.

Rutuja Khedekar

Freelance Copywriter

Rutuja is a finance content writer with a post-graduate degree in M.Com., specializing in the field of finance. She possesses a comprehensive understanding of financial matters and is well-equipped to create high-quality financial content.