Introduction

TDS, or Tax Deducted at Source, is a fundamental aspect under the Goods and Services Tax (GST) rules, ensuring a portion of the payment is deducted upfront as tax during transactions. This process, defined by GST TDS rates, serves as a compliance measure in the GST system, enforcing adherence to tax rules. If you’re making a payment, you might deduct a small part as tax, with GST TDS threshold limits dictating when this process applies. Understanding TDS under GST is akin to grasping a basic rule, emphasizing fairness by paying a bit upfront instead of later and sets the stage for exploring more about how TDS works, its rules, and its significance for businesses.Legal Framework of TDS under GST

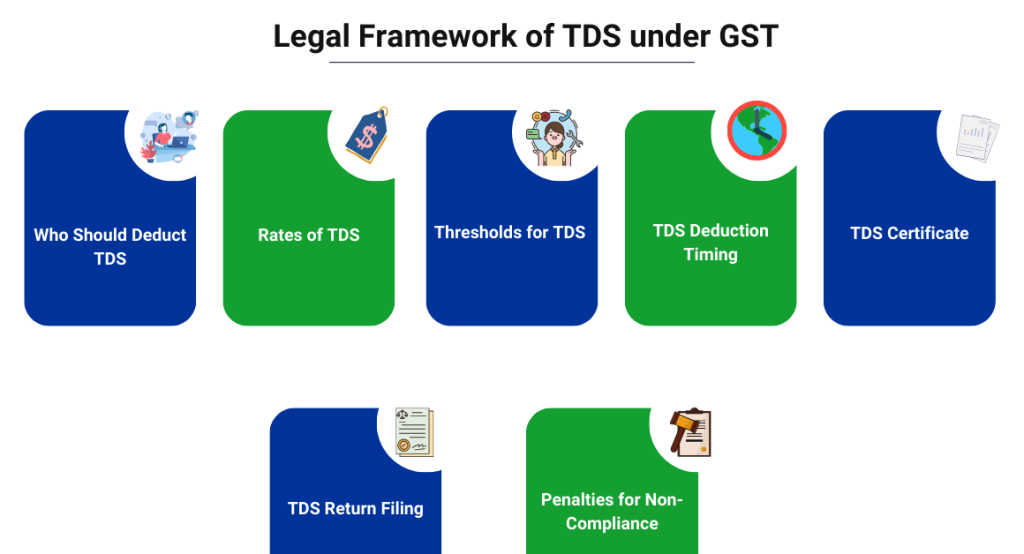

The rules are like the guidelines everyone has to follow when it comes to deducting tax from payments. When we say “legal framework,” we mean the official rules set by the government to make sure TDS is done the right way. These rules tell us who needs to deduct how much tax and when. It’s like having a clear set of instructions that everyone playing the tax game has to stick to.

Let’s understand the rules:

The rules are like the guidelines everyone has to follow when it comes to deducting tax from payments. When we say “legal framework,” we mean the official rules set by the government to make sure TDS is done the right way. These rules tell us who needs to deduct how much tax and when. It’s like having a clear set of instructions that everyone playing the tax game has to stick to.

Let’s understand the rules:

-

Who Should Deduct TDS:

- Businesses or individuals making specific types of payments, like to contractors or professionals, may need to deduct TDS.

-

Rates of TDS:

- The government sets rates at which TDS should be deducted. It’s like a small percentage of the payment that needs to be kept aside as tax.

-

Thresholds for TDS:

- Not all payments have TDS. There’s a limit, a threshold. If the payment is below this limit, TDS may not be applicable.

-

TDS Deduction Timing:

- TDS should be deducted at the time of making the payment. It’s like taking a little bit of tax out right when you’re paying someone.

-

TDS Certificate:

- After deducting TDS, the person making the payment needs to give a certificate to the one receiving the payment. It’s like a proof that the tax has been deducted.

-

TDS Return Filing:

- The person deducting TDS has to file a return. It’s like telling the government, “Hey, we deducted this much tax, and here are the details.”

-

Penalties for Non-Compliance:

- If someone doesn’t follow these rules, there can be penalties. It’s like a consequence for not playing by the TDS rules.

Understanding TDS Rates and Thresholds

TDS rates, set by the government, differ for various payments like those to contractors or consultants. Not all payments trigger TDS; there’s a threshold limit, a minimum amount above which TDS is applicable, serving as a cutoff for tax deduction. The provided chart shows some TDS sections, but additional details can be checked on the government portal.| TDS Section | Nature of Payment | Threshold (₹) | For Individual / HUF | For Others |

| 192 | Salaries | ₹ 2,50,000 | Slab Rates | Slab Rates |

| 192A | EPF Withdrawal | ₹ 50,000 | 10% | 10% |

| 193 | Interest on Securities | ₹ 10,000 | 10% | 10% |

| 194 | Dividend Distribution | ₹ 5,000 | 10% | 10% |

| 194A | Interest from Banks/Post Office | ₹ 40,000 (₹ 50,000 for senior citizens) | 10% | 10% |

| 194B | Lottery Winnings | Aggregate of ₹ 10,000 | 30% | 30% |

| 194BA | Online Game Winnings | – | 30% | 30% |

| 194BB | Horse Race Winnings | ₹ 10,000 | 30% | 30% |

| 194S | TDS on Cryptocurrencies | Not Applicable | 1% | 1% |

| 206AA | TDS Without PAN | Not Applicable | At a higher rate than: The rate specified by the act 20% The currently applicable rate | At a higher rate than: The rate specified by the act 20% The currently applicable rate |

| 206AB | TDS on Non-filers | Not Applicable | The higher of: 5% Twice the rate mentioned in the provision The currently applicable rate | The higher of: 5% Twice the rate mentioned in the provision The currently applicable rate |

Procedure for TDS Deduction under GST

Let’s break down the procedure:

Let’s break down the procedure:

-

Identify TDS Applicability:

- Check if TDS applies to your payment based on its type and amount. Not all payments require TDS.

-

Check Threshold Limits:

- Verify if the payment exceeds the threshold limit; if not, TDS may not be applicable. It’s like deducting tax only when the amount is significant.

-

Verify GST Registration:

- Ensure the deductee is registered under GST, as TDS usually applies when both parties are registered.

-

Obtain PAN:

- Collect the deductee’s PAN, a crucial step required for TDS deduction. It’s like gathering necessary information.

-

Determine TDS Rate:

- Find the applicable TDS rate for your payment type, as different categories have different rates.

-

Calculate TDS Amount:

- Calculate the TDS amount by applying the rate to the payment. It’s like figuring out the tax from the payment.

-

Deduct TDS from Payment:

- Deduct the calculated TDS amount from the total payment, setting it aside as tax.

-

Generate TDS Certificate:

- Issue a TDS certificate to the deductee after deduction, confirming the amount withheld.

-

File TDS Return:

- Periodically file a TDS return, typically quarterly, reporting details of TDS deducted to the government.

-

Compliance with Due Dates:

- Adhere to TDS return filing due dates to avoid penalties, ensuring timely submission of tax-related information.

Key Compliance Aspects and Challenges

| Key Compliance | Challenges |

| Understanding the Rules: The first thing is to know the rules. It’s like understanding the instructions of a game. For TDS under GST, this means grasping when and how to deduct tax. | Understanding the Rules Can Be Tricky: Sometimes, the rules can be a bit confusing. It’s like trying to figure out the rules of a new game. Businesses might find it challenging to understand all the details. |

| Following Thresholds: There are certain limits (thresholds) for TDS. If the payment is below that limit, you might not need to deduct tax. It’s like deciding when to start playing the tax game. | Keeping Track of Thresholds: Remembering when to start deducting tax and when not to can be a challenge. It’s like trying to remember the special conditions in a game. Missing this might lead to mistakes. |

| Calculating Right: Doing the math correctly is important. You need to calculate the right amount of tax to deduct. It’s like making sure you take the correct number of steps in a game. | Ensuring Accurate Calculations: Making sure you calculate the right amount of tax is crucial. It’s like being careful with your moves in a game. Mistakes in calculations can lead to issues. |

| Filing Returns: Periodically, you need to tell the government about the tax you deducted. It’s like reporting your scores in the game. This is done through a process called “filing returns.” | Staying on Top of Filing Returns: Regularly filing returns is a commitment. It’s like consistently updating your game scores. Missing this step can lead to penalties. |

Advantages of TDS under GST

Understanding the advantages is like recognizing the benefits of playing by the rules in a game. Let’s understand in detail:-

Ensures Timely Tax Collection:

- TDS ensures a portion of tax is collected during the transaction, like earning points right when you make a move in a game.

-

Prevents Tax Evasion:

- TDS prevents tax evasion by deducting tax upfront, ensuring everyone pays their fair share—like a rule in a game to prevent cheating.

-

Encourages Compliance:

- The existence of TDS encourages people to follow tax rules, creating a fair game where everyone plays by the rules.

-

Simplifies Tax Collection:

- TDS simplifies tax collection, creating an organized way of collecting points in a game and making it easier for the government to manage revenues.

-

Promotes Transparency:

- TDS brings transparency to the tax system, like having clear rules in a game, reducing confusion, and ensuring a level playing field.

-

Reduces Tax Burden:

- By deducting tax in smaller amounts at the time of payment, TDS breaks down the burden, similar to breaking down a big task into smaller steps in a game.

-

Facilitates Compliance Tracking:

- TDS provides a clear record of tax deductions, like keeping a scorecard in a game, aiding in tracking who has paid how much tax and ensuring accountability.

-

Aids Government Revenue Planning:

- Upfront tax collection through TDS helps the government plan revenue, akin to knowing how many points you have in a game and strategizing accordingly.

-

Minimizes Tax Evasion Risks:

- TDS minimizes the risk of tax evasion by collecting tax right away, acting as a security system in a game to catch any unfair moves.

-

Contributes to Efficient Tax Administration:

- TDS contributes to efficient tax administration, creating a well-organized game where everyone follows the rules, making management and administration easier.

Impact of TDS on Different Business Sectors

| Business Sector | Impact of TDS |

| Manufacturing | Helps in regularizing tax payments and ensures timely collection. Reduces the chances of tax evasion. |

| Service Providers | Simplifies tax compliance, encouraging businesses to adhere to regulations. Enhances transparency in financial transactions. |

| Real Estate | Facilitates organized tax deductions during property transactions. Contributes to a systematic tax collection process. |

| Retail | Eases the burden of large tax payments by deducting smaller amounts at the time of transactions. Encourages compliance and transparency. |

| Construction | Ensures timely tax deductions for contractors and builders. Aids in financial planning and tracking of tax payments. |

| IT and Software | Streamlines tax compliance, making it easier for tech businesses to manage their financial responsibilities. Encourages adherence to tax regulations. |

| Healthcare | Provides a structured approach to tax deductions in the healthcare sector. Supports compliance and contributes to a transparent financial system. |

| Hospitality | Reduces the risk of tax evasion in the hospitality industry. Ensures systematic tax collection and contributes to efficient tax administration. |

| Agriculture | Simplifies tax processes for agricultural transactions. Encourages compliance and transparency in financial dealings within the agriculture sector. |

Comparison of TDS under GST with Earlier Tax Regimes

Here’s a simplified comparison of TDS under GST with earlier tax regimes in tabular format:| Aspect | TDS under GST | Earlier Tax Regimes in India |

| Timing of TDS Deduction | Deducted at the time of payment | Deducted at the time of payment or during specified intervals |

| Rates and Thresholds | Different rates for various types; thresholds apply | Varied rates and thresholds based on the specific tax regime |

| Nature of Payments Covered | Covers specific types of payments | Coverage varied based on the tax laws prevailing at the time |

| Compliance Requirements | Follows a standardized procedure | Compliance requirements differed based on the tax structure |

| Administration and Tracking | Administered as part of the GST system | Administered separately under different tax laws |

| Simplicity in Processes | Aimed at simplifying tax processes | Processes could be complex and varied under different regimes |

| Impact on Businesses | Intended to bring uniformity and transparency | Impact varied based on the complexity of earlier tax structures |

Conclusion

In conclusion, understanding TDS under GST is like knowing the rules of a game. It helps businesses deduct the right amount of tax at the right time. TDS makes tax collection fair and transparent, benefiting both businesses and the government. Following the procedures, calculating accurately, and staying compliant are key. With TDS, it’s like playing the tax game by the rules, ensuring everyone contributes their share for a well-organized and efficient tax system. Also Read: How to Calculate GST in an Excel Sheet: Step-by-Step GuideFAQ’s

-

What is TDS under GST?

- TDS under GST is akin to giving a small part of the payment to the government as tax right when you make a payment.

-

What are the rules for TDS in GST?

- The rules for TDS in GST are like game instructions, specifying when and how much tax to deduct.

-

How do I know the TDS rate for my payment?

- Different payments have different rates, similar to different levels in a game. You need to find out the specific rate for your type of payment.

-

Is there a limit for TDS to apply?

- Yes, there’s a limit, like a minimum score in a game. If your payment is below this limit, you might not need to deduct tax.

-

What’s the step-by-step process for TDS deduction in GST?

- Deducting TDS follows steps like a game. You identify, calculate, deduct, and then report to the government.

-

What should I do if I make a mistake in TDS calculation?

- If you make a mistake in calculating TDS, it’s like an error in a game. Correct it as soon as you realize and report the correct details to the government.

-

How does TDS make tax compliance easier?

- TDS makes tax compliance easier by deducting a smaller amount of tax at the time of payment, like breaking down a big task into more manageable steps.

-

Does TDS impact all businesses in the same way?

- No, TDS affects different businesses differently, much like certain rules applying to specific players in a game. The impact depends on the type of business.

-

What’s the advantage of TDS in GST for small businesses?

- TDS helps small businesses by deducting a smaller amount of tax at the source, making the tax process more manageable and less burdensome.

-

How is TDS under GST different from earlier tax regimes?

- TDS under GST is like a new version of the game with simpler rules, bringing uniformity and transparency unlike the varied processes in earlier tax systems.

Get answers to common TDS under GST questions easily with CaptainBiz.

Anjali Panda

Senior Content Writer

Anjali Panda, a skilled wordsmith and literature enthusiast, earned her bachelor's degree in English Language and Literature from KiiT University. Her Highest Qualification Holding an MBA in Finance, she effortlessly blends academic knowledge with practical insights in her finance-centric content. Presently, Anjali is leveraging her financial expertise at BitWale, a startup, where she plays a pivotal role in optimizing the company's overall financial operations