Introduction

In her sixth union budget, Finance Minister of India, Nirmala Sitharaman, will give an interim budget. It is crucial to note that the interim budget will be presented before the 2025 general elections. Some of the interim budget 2025 expectations are that it would address some of the most crucial challenges plaguing the industry for many years. Some of the sectors include renewables, power, and the utilities sectors. The budget may focus on the infrastructure development offered to industries, along with tax relief. Industry experts also anticipate that digital payments, infrastructural expansion, and many green projects, will get some tax relief. Source: https://smefutures.com/market-sentiments-and-investor-reactions-gauging-pre-interim-budget-expectations/ The NDA government understands this budget will be crucial in wooing the voters by providing them with new budget goals and, at the same time, reducing the fiscal deficit increase. Other sectors like the medical, fertilisers, and chemicals, have expressed concerns like dumping, subsidies, and high taxes.Setting the Stage for 2025

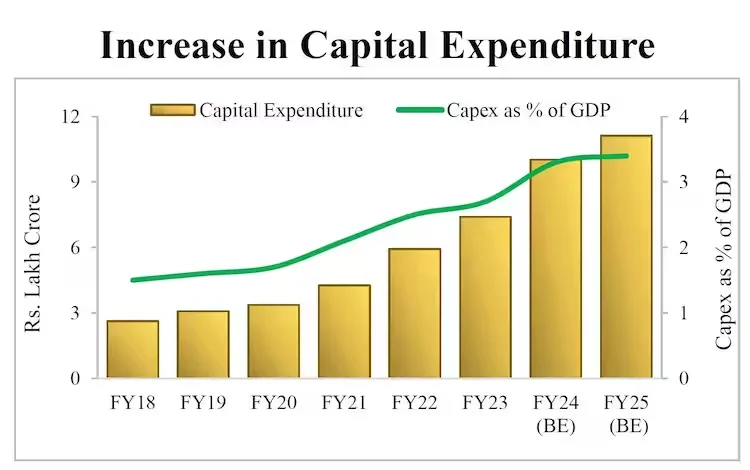

Source: https://www.indiatoday.in/business/budget-2024/story/interim-budget-2024-government-capital-expenditure-outlay-over-rs-11-lakh-crore-2496354-2024-02-01

During the interim budget presented in 2019, Piyush Goyal announced individual taxpayers with Rs. 5 lakhs annual income, will not be taxed. Besides, those having Rs. 6.50 lakhs annual income, need not pay any tax, provided they make investments.

V Anantha Nageswaran, who is the Chief Economic Advisor, feels that investments in the private sector could prove crucial at the moment. India has seen several successful start-ups that are doing very well, with a shift from the consumption scale.

The Interim Budget 2025 looks good for the railways, and the healthcare industry. This is in alignment with the various schemes that were started by the government. The budget should play an active role in ensuring that the vision for India is achieved in the next few years.

Source: https://www.indiatoday.in/business/budget-2024/story/interim-budget-2024-government-capital-expenditure-outlay-over-rs-11-lakh-crore-2496354-2024-02-01

During the interim budget presented in 2019, Piyush Goyal announced individual taxpayers with Rs. 5 lakhs annual income, will not be taxed. Besides, those having Rs. 6.50 lakhs annual income, need not pay any tax, provided they make investments.

V Anantha Nageswaran, who is the Chief Economic Advisor, feels that investments in the private sector could prove crucial at the moment. India has seen several successful start-ups that are doing very well, with a shift from the consumption scale.

The Interim Budget 2025 looks good for the railways, and the healthcare industry. This is in alignment with the various schemes that were started by the government. The budget should play an active role in ensuring that the vision for India is achieved in the next few years.

What is the Difference Between Interim Budget and Vote on Account?

| Feature | Interim Budget | Vote on Account |

| Constitutional Provision | Article 112 | Article 116 |

| Purpose | Financial Statement presented by the government ahead of general elections. | To meet essential government expenditures for a limited period until the budget is approved. |

| Duration of Expenditure | Covers a specific period, usually a few months until a new government is formed and a full budget is presented. | It is generally granted for two months for an amount equivalent to one-sixth of the total estimation. |

| Policy changes | Can propose changes in the tax regime | Cannot change the tax regime under any circumstances |

| Impact on Governance | Provides continuity in governance during the transition period between two governments. | Ensures the smooth functioning of the government and public services until the regular budget is approved. |

Crucial Sectors in Focus

Some sectors require more attention than others. They include the infrastructure, power & utilities, cement, and pharmaceutical industries. The interim budget should focus on these industries to ensure that there is growth & development in the country. Let us read about the industry impact of interim budget.-

Infrastructure

-

Cement Sector

-

Power and Utilities

-

Consumer Durables

-

Pharmaceutical

Sustainable Development Initiatives

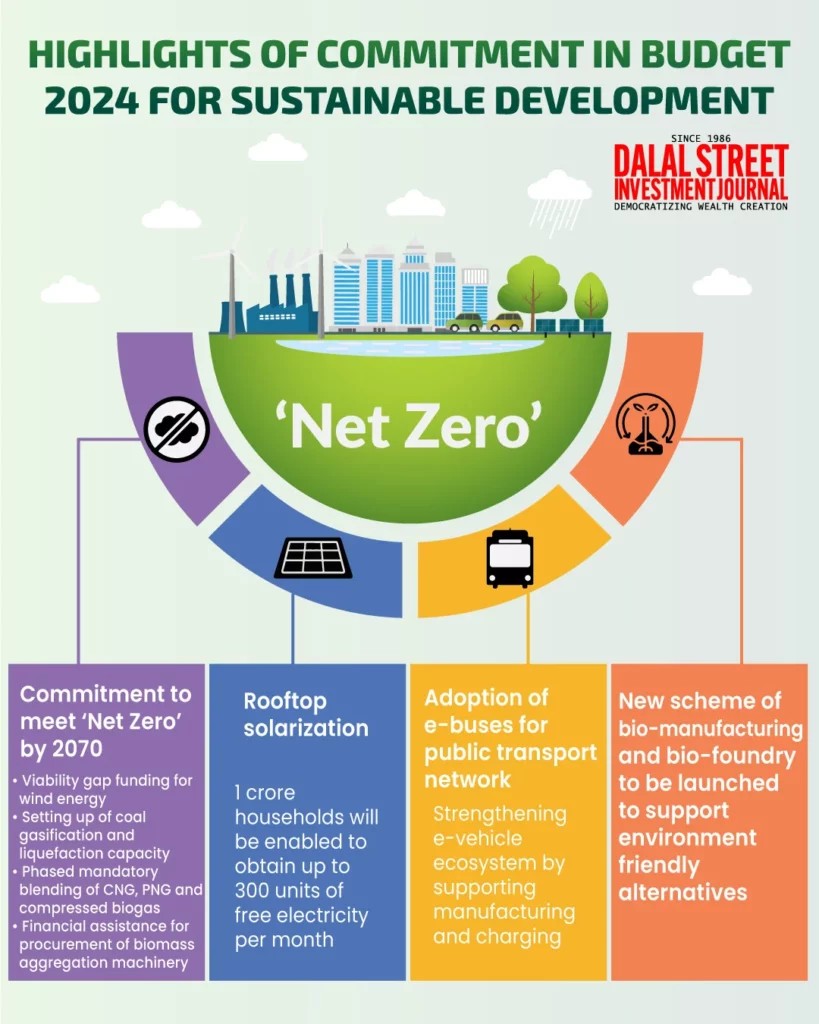

Source: https://www.dsij.in/dsijarticledetail/highlights-of-commitment-in-budget-2024-for-sustainable-development-36256

The government has taken serious note of the green revolution, and they have implemented certain goals that should be achieved before 2060. The budget has come up with a comprehensive plan that can make India sustainable in green energy.

Being the most populated country in the world, unless India starts planning now, it will become a now-or-never strategy. Perhaps, it may be too late to even implement anything for that matter. This thought approach showcases a good commitment to foster a clean nation.

The main initiatives involve offering gap funding to establish 1 GW of offshore wind energy capacity. This can be done through the production of several machines & equipment so that the dependence on fossil fuels is reduced significantly.

Some of the sustainable development initiatives in budget 2025 have been discussed below:

Source: https://www.dsij.in/dsijarticledetail/highlights-of-commitment-in-budget-2024-for-sustainable-development-36256

The government has taken serious note of the green revolution, and they have implemented certain goals that should be achieved before 2060. The budget has come up with a comprehensive plan that can make India sustainable in green energy.

Being the most populated country in the world, unless India starts planning now, it will become a now-or-never strategy. Perhaps, it may be too late to even implement anything for that matter. This thought approach showcases a good commitment to foster a clean nation.

The main initiatives involve offering gap funding to establish 1 GW of offshore wind energy capacity. This can be done through the production of several machines & equipment so that the dependence on fossil fuels is reduced significantly.

Some of the sustainable development initiatives in budget 2025 have been discussed below:

-

Empowering homes through the “Muft Bijli”

-

Green Transportation

Employment and Skill Development

Source: https://nationalskillsnetwork.in/union-budget-2024-highlights-on-skill-development-education-and-entrepreneurship/

The main objective of the interim budget was generating employment and skill development. India’s unemployment scenario presents a grim figure, and unless the government provides some fast remedy, things may not improve.

However, the Finance Minister has stressed that the government is taking this matter seriously. There is a rise in employment opportunities that have been provided due to the various government schemes.

The interim budget 2025 expectations for the criteria are given below:

Source: https://nationalskillsnetwork.in/union-budget-2024-highlights-on-skill-development-education-and-entrepreneurship/

The main objective of the interim budget was generating employment and skill development. India’s unemployment scenario presents a grim figure, and unless the government provides some fast remedy, things may not improve.

However, the Finance Minister has stressed that the government is taking this matter seriously. There is a rise in employment opportunities that have been provided due to the various government schemes.

The interim budget 2025 expectations for the criteria are given below:

-

Encouraging Entrepreneurship

-

Green Growth Through Biomass

-

Skill India Mission

Infrastructure and Connectivity

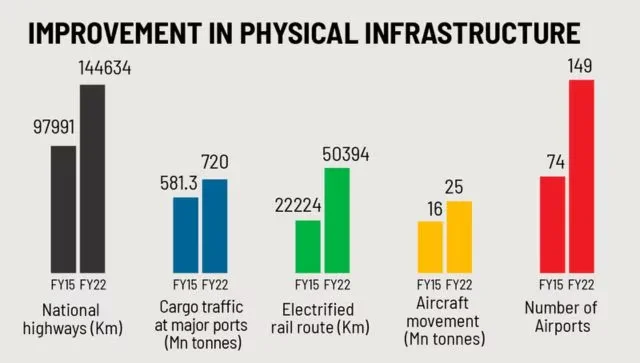

Source: https://www.firstpost.com/india/what-budget-2024-is-telling-the-world-and-you-about-india-13679172.html

The Interim Budget for 2025-26, has been inspired by “Viksit Bharat.” They want to ensure that they have a smoother approach to economic growth, social development, and inclusivity. There has been an allocation of close to Rs. 47,65,768 crore.

This is a massive increase of 2.8% from the previous year for funds provided to the infrastructure management. Moreover, approximately Rs.2.78 lakh crores have been allocated to the Ministry of Road, Transport and Highways, the second highest budget allocation.

Source: https://www.firstpost.com/india/what-budget-2024-is-telling-the-world-and-you-about-india-13679172.html

The Interim Budget for 2025-26, has been inspired by “Viksit Bharat.” They want to ensure that they have a smoother approach to economic growth, social development, and inclusivity. There has been an allocation of close to Rs. 47,65,768 crore.

This is a massive increase of 2.8% from the previous year for funds provided to the infrastructure management. Moreover, approximately Rs.2.78 lakh crores have been allocated to the Ministry of Road, Transport and Highways, the second highest budget allocation.

-

Viability Gap Funding

Taxation Reforms

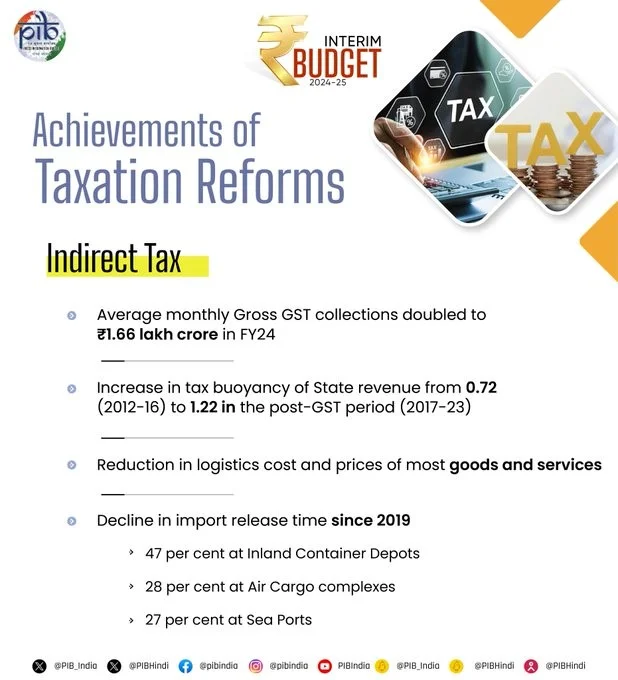

Source: https://pendulumedu.com/blog/major-highlights-of-interim-budget-2024

Some of the various taxation reforms and business impact have been discussed below:

Source: https://pendulumedu.com/blog/major-highlights-of-interim-budget-2024

Some of the various taxation reforms and business impact have been discussed below:

- The GST collection was at Rs. 1.6 crore in December 2023. The gross GST revenues have crossed 1.6 lakh crore.

- The average monthly gross GST collection has doubled to Rs. 1.6 crore in FY24.

- There has been an increase in the tax buoyancy of state revenue from 0.72 to 1.22 post-GST period.

- A Rs. 75,000 crore for a 50-year free interest has been proposed for state governments.

- There is a tax exemption for IFSC units up to March 31st, 2025.

- The outstanding direct tax of Rs.25,000 will be withdrawn.

Financial Sector Revisions

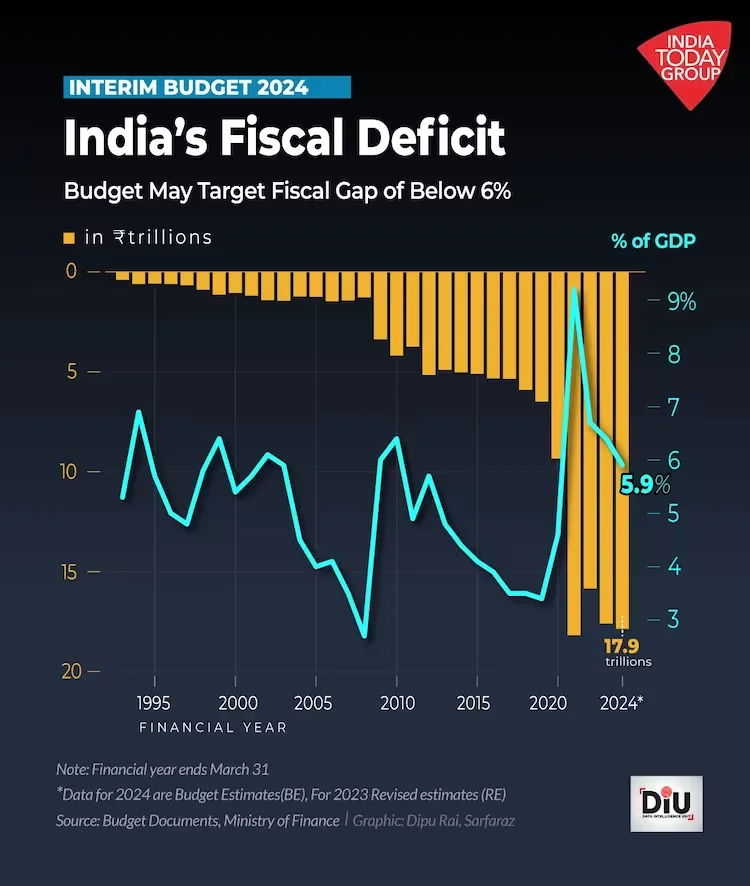

Source: https://www.indiatoday.in/business/budget-2024/story/budget-2024-these-5-charts-explain-what-to-expect-from-the-interim-plan-2493177-2024-01-24

The economic trends in interim budgets were void of any significant tax relief or tax adjustments.

Source: https://www.indiatoday.in/business/budget-2024/story/budget-2024-these-5-charts-explain-what-to-expect-from-the-interim-plan-2493177-2024-01-24

The economic trends in interim budgets were void of any significant tax relief or tax adjustments.

- There is an estimated nominal GDP growth of 10.5%.

- The mop-up from central public sector enterprises (CPSEs) disinvestment is at Rs. 50,000 crore.

- The gross tax revenue target is hiked 11.46% to Rs. 38.31-lakh crore.

- The direct tax collection target has been set at Rs. 21.99-lakh crore.

- The white paper on mismanagement will be released by the government before 2014.

- The next-generation reforms will be unveiled.

- They will form a high-powered panel to address population growth challenges.

Conclusion

The interim budget 2025 expectations are immense. Several industry leaders, analysts, and statisticians, are excited with the awaited breath about the interim budget. The budget for the last few years has been just about average. Most of the tax slabs have been increased, this interim budget has a lot hanging in the balance. We expect to see a budget that can play a multifaceted economic strategy. The Finance Minister may want to plan for cleaner energy, infrastructure, and goals to enhance financial growth. Several industry leaders & analysts anticipate crucial support for major sectors. However, the Finance Minister may also want to give attention to some of the crucial public sectors like the railways, and power & utilities. The Finance Minister will also concentrate on the progress of various schemes that were initiated by the government. As we look forward, we sincerely hope that the interim budget satisfies the needs of the middle class, which serves as the backbone of the country. Also Listen: The Impact of GST on Tax RevenueFAQs

-

What is an “Interim Budget”?

-

What can be expected from the budget in 2025?

-

What industries will benefit from the budget 2025?

-

How the interim budget can impact the stock market?

-

Which stock to buy after the 2025 budget?

-

What to expect from an interim budget?

-

What could be the highlights of the 2025 budget?

-

What can the common man expect from the budget in 2025?

-

What is the interim budget for agriculture in 2025?

-

What is the budget allocation for 2025?

Stay informed on Interim Budget 2025 highlights and sector insights at CaptainBiz.

Sumith Roul

Content Writer

Sumith Roul has post-graduation in computer science from Vellore Institute of Technology (VIT), then he decided to become a content writer. He has a writing career spanning more than 18 years, and He has worked with several international clients. His work involves several niches including GST, finance, stock market, and so on. I have designed & worked on several hundred product reviews, blogs, PRs, and other forms of content as well.