Manual invoicing vs. GST software: The change in billing methods shows the advantages of GST billing software and manual invoicing vs. GST software. People were able to wait for days. People are more interested in making purchases now that they may pay quickly and easily. Sales and inventory management for retailers and wholesalers were made easier by introducing billing software.

Businesses may see their stock availability in real time using billing software, which facilitates billing. Customers get a better experience when they utilize the proper billing software in the company. In addition, it offers solutions that streamline and simplify tasks like GST registration, inventory management, and invoicing.

Also Read: GST Billing Software Vs. Traditional Invoicing Methods

Overview

How is the software used to generate invoices? The primary goal of most billing software is to streamline and improve the quality of billing processes. If your company requires frequent billing, a billing system could simplify the process with GST billing software advantages while preventing human mistakes. Its purpose is to facilitate the expedited collection of payments by facilitating the accurate recording of financial transactions and the upkeep of an accounting database.The Evolution of Invoicing Methods

Because of technological advancements, billing operations have evolved from paper-based methods to electronic and online systems, simplifying the process. Businesses benefited from increased efficiency, accuracy, and transparency in invoice management by introducing electronic invoicing and online invoicing software. Efforts by regulators to standardize requirements attempt to promote transparency and GST compliance in business invoicing, while blockchain-based invoicing systems offer heightened security and immutability. In general, the evolution of billing practices indicates a trend toward automation and digitalization, which are improving financial processes and easing transactions in today’s workplace.What is GST Billing Software?

Streamline your billing and invoicing procedures using GST billing software, a tool that helps companies comply with Goods and Services Tax (GST) requirements. Invoice creation and management, tax calculation, report generation, inventory management, and payment monitoring are some functions often found in GST invoicing software. Businesses may save time and avoid mistakes with its automated invoicing system that guarantees precise GST compliance. Automated Invoice Processing

How Does Billing and Invoicing Software Work?

Because of the many GST billing software advantages over manual or paper-based billing, an increasing number of companies are moving to electronic invoicing. To allocate more resources to other areas of operation, most organizations would rather not deal with the processing time and expenses connected with the conventional billing system. Businesses may save money on printing and postage, reduce deadlines, and improve productivity using billing software’s unified invoicing processes. The primary benefits of automated invoicing are the improvements in efficiency and the reductions in costs. Academics in the field of accounting have found that the best invoicing software may enhance supplier and customer relationships and working capital management. It is unnecessary to have a specialized financial staff to manage the day-to-day accounting needs of a small company. All of the billing tasks may be handled by you individually. Several of the most fundamental accounting tasks are readily available in invoicing software, and we’ve outlined them below.#1. Make and send out invoices.

With today’s billing software, company owners may view their financial data whenever and wherever they choose. Invoices may be made more easily and customized with the use of cloud-based invoicing software. Unlike traditional invoices, which need you to manually fill out each field, this one only requires you to click a few buttons. When it comes to reoccurring bills, you may automate the process as well. Creating, editing, and adding a logo or other company symbol to your invoices has never been simpler. With sophisticated billing software, importing client databases is as easy as clicking a button. At your fingertips, you may easily turn quotes that clients have authorized into bills. With the integrated system, you may submit your GST returns itself.#2. Efficient Billing and Payment Process

Without requiring any extra configuration, online invoicing platforms make billing and payments easy. Your clients may pay you immediately upon receiving their bills through the web portal. One of the features of a valid billing system is the capacity to collect payments in more than one currency. You may streamline your payment processes and get your money quicker with updated web platforms that enable you to integrate third-party payment apps or credit card payments. In most cases, billing software will include capabilities to manage many languages, currencies, and tax adjustments.#3. Quickly Generate Reports

In order to maintain track of their finances and check unpaid bills, company owners may use billing software to provide rapid reports. With the help of automation, you can easily generate reports and export data as PDF files, which you can then send via email. Quick and easy reporting makes data analysis simple and gives you all the details you need about your invoicing operations, such as how many bills are still unpaid, how long a payment cycle lasts, how many clients pay on time, and all that stuff.Manual Invoicing: Traditional Approach

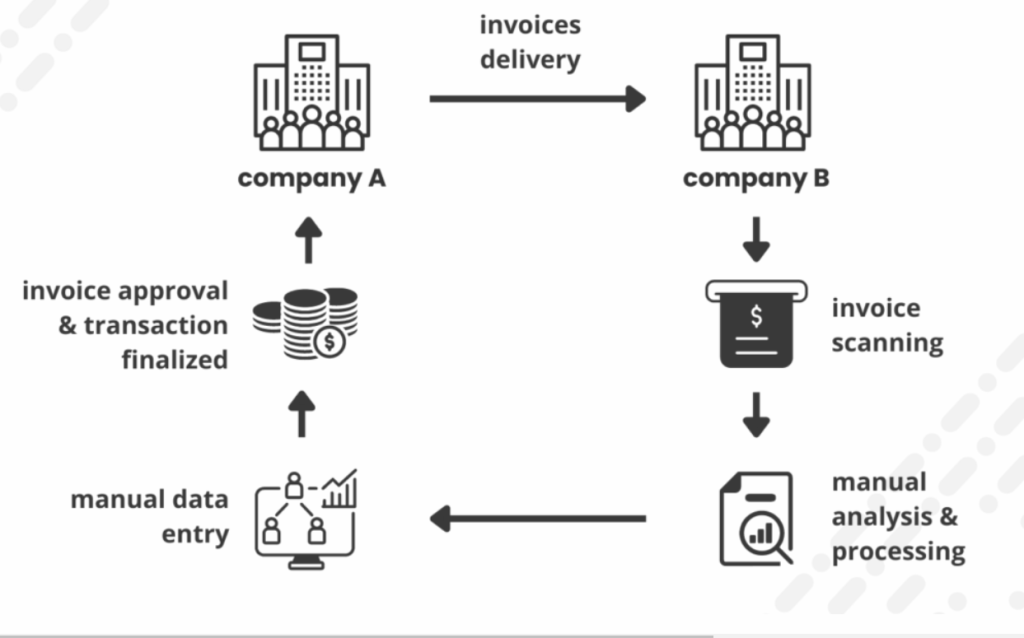

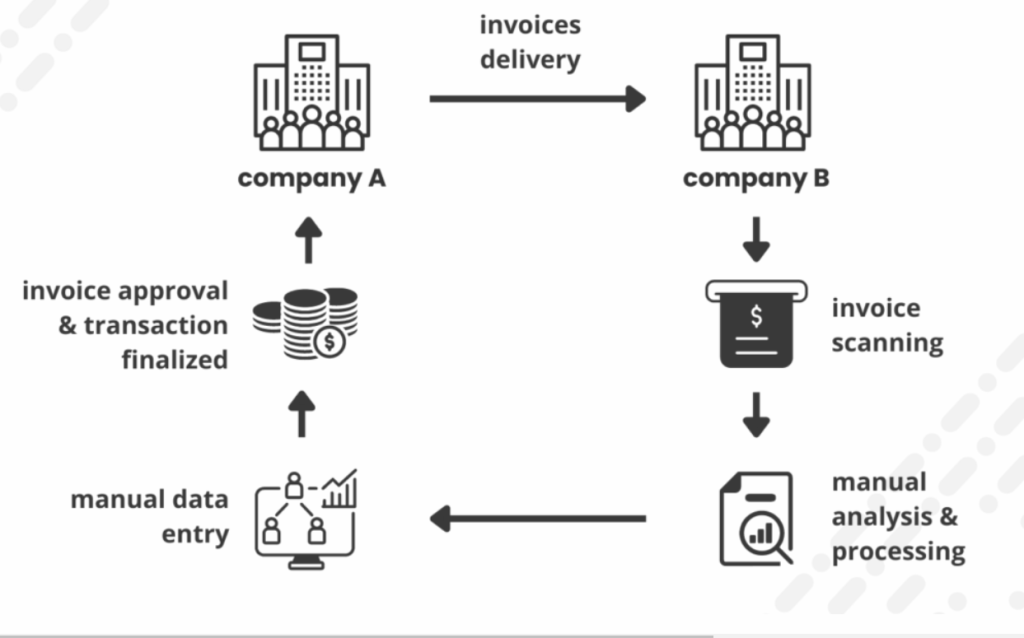

Creating, organizing, and delivering bills by physical paper-based processes without the use of digital technology is known as manual invoicing or the traditional approach to invoicing. In this method, companies regularly use typewriters or write by hand to create invoices, which they then fill out with important details such as product or service specifics, quantities, pricing, and total amounts required. Customers get these paper bills either via regular mail or personally. Repetitive activities, tangible papers, and human labor define the conventional manual invoicing process. It often requires the use of space-consuming and inconvenient file cabinets or folders to store paper documents. Furthermore, there is a higher chance of billing and accounting errors when using manual invoicing due to human mistakes, which could appear as typos, incorrect calculations, or lost documentation. Manual invoicing has its drawbacks, yet it is still utilized by a lot of companies. This is particularly so for smaller businesses that don’t have the cash to invest in digital solutions or deal with high transaction volumes. Digital invoicing solutions have grown more accessible and affordable, so many businesses are moving away from manual invoicing and towards electronic and online invoicing. Manual Invoice Processing

Benefits of Automated invoicing

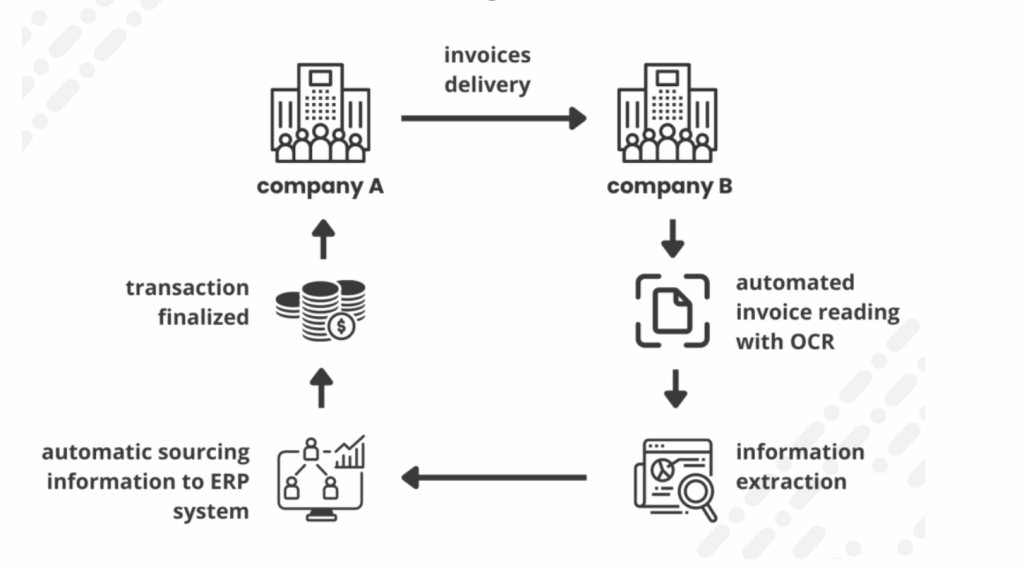

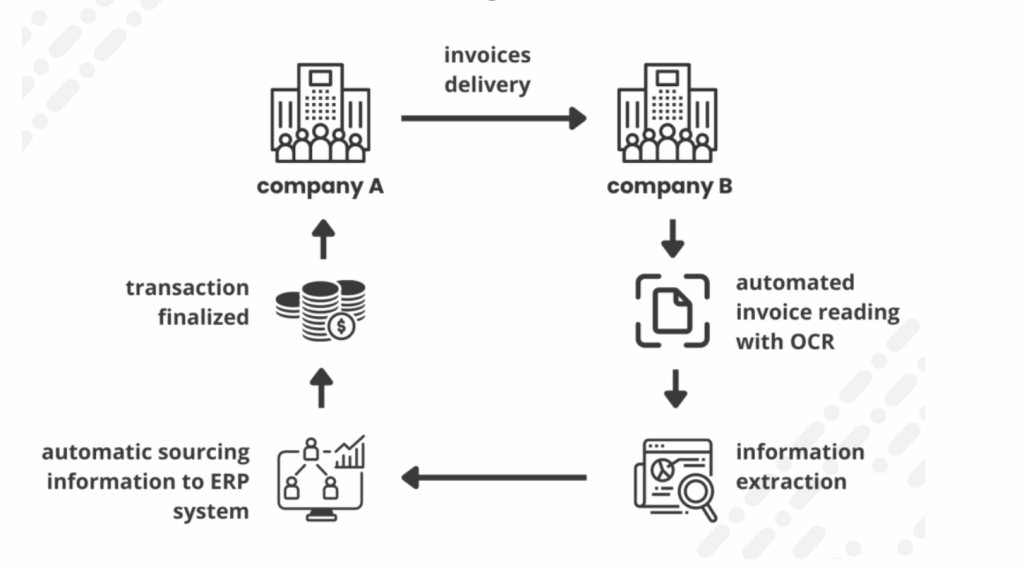

By automatically extracting, filling, and storing your invoice data, automated invoice processing software streamlines your Accounts Payable activities, allowing you to execute payments with only a few clicks. Invoice processing poses a risk to some B2B companies due to the high operating expenses, a higher probability of human mistakes, and a large number of invoices. Therefore, you may save time and money by switching to automated invoice processing. This method additionally reduces the possibility of human mistakes, which is a common problem in manual processes. So, let’s see the benefits of automated invoicing.- Speeds up the processing

- It saves time

- Placing the Hiring Process

- Minimize Errors in Processing Invoices

- Gain Control and Transparency

- Improve Employee Productivity

- Data Collection and Improved Insights

- Grow With Machine Learning

Manual invoicing vs. GST software

Sending and receiving invoices, monitoring their payment status, and keeping track of client accounts were all parts of the manual, paper-based process that was the conventional method of invoicing. However, the usage of digital platforms and current technologies has completely transformed modern billing. Businesses now have more options than ever before to automate and simplify their invoicing management operations thanks to these platforms. Also, new capabilities like built-in payment acceptance and data-driven analytics are available with current invoicing software and tools, which gives companies access to enterprise-level resources. How companies handle the process, and the level of automation and customization offered is the key distinctive features between old and contemporary approaches to invoices., and the level of automation and customization. However, this does not conclude here, which is why we are providing a comprehensive comparison of old-fashioned and contemporary invoices.Know the differences: Manual invoicing vs. GST software.

- Format: A paper invoice was the standard mode of presentation for traditional invoices. Electronic invoicing has been the norm in recent years, with bills being delivered and received in this way.

- Reliability: The delivery time of conventional invoices was days, if not weeks, since they were sent by regular mail. Payments may be received and processed considerably more quickly with modern electronic invoicing.

- Accuracy: Because they relied on human input, conventional invoices were subject to slip-ups and under-or overages. As a result of advancements in software and payment methods, modern bills use more accurate billing software.

- Make things easier: Putting bills into multiple programs was challenging and took a lot of time. Because bills are easier to understand these days, it’s faster and easier to use different systems and methods.

- Safety: Old-fashioned bills didn’t have any safety features, so it was easy to cheat and mess them up. Security technology in modern bills can keep important client information safe.

- Automated processes: The old way of paying can take hours or even days to finish because the forms have to be created and filled out by hand. These days’ bills are easier to handle because they are more automated.

- Tracking: Because there was no simple method to know where an individual invoice was, traditional invoices were more difficult to track and monitor. You can see more of the process with modern invoices since they are easier to manage and monitor.

- Discounts: Offering discounts to clients and processing them was a challenge with conventional invoicing. Customers may get the discounts for which they qualify with the help of modern invoices that make it easy to apply discounts.

- Payment Options: Traditionally, customers could only pay bills via check or cash. More payment methods, including Internet and credit/debit card processing, are available to consumers with modern invoices.

- Remittance: In the past, when clients had to pay using a check or cash, they typically had to include the payment details in the physical mailing of the invoice. With the use of invoicing software, customers may pay their bills online by sending their payment details with the invoice.

- Reminders: Due to the laborious nature of tracking traditional invoices, clients were not always sure when payment was due. One convenient feature of modern invoices is the ability to set a reminder for when payment is due. This makes it much simpler to collect payments on time.

| The Aspect | Manual Invoicing | GST Software |

| Invoicing Process | Manual creation, printing, and distribution of invoices. | Automated generation and distribution of invoices |

| Efficiency | Time-consuming and prone to errors | Streamlined and efficient, reducing manual effort |

| Scalability | Limited scalability as business grows | Scales easily to accommodate business growth |

| Accuracy | Susceptible to human errors | Ensures accuracy through automated calculations |

| Compliance | Relies on knowledge of tax laws and regulations | Built-in compliance features to ensure GST compliance |

| Data Security | Vulnerable to loss or damage | Offers data security measures to protect sensitive information |

| Record-keeping | Requires manual record-keeping | Automatically maintains digital records |

| Invoice Tracking | Manual tracking of invoice status | Provides real-time tracking of invoice status |

| Reporting | Manual compilation of reports | Generates GST-compliant reports automatically |

| Integration | Limited integration with accounting systems | Works with accounting software to make data flow smoothly |

The Regulatory GST compliance in business invoicing

Any sector has rules, and companies must follow them. Compliance may include many organizational policies, procedures, and activities. It is probable that a company will have more than one area of compliance. Different types of GST compliance in business invoicing are listed below. Financial Compliance: Organizations must keep fair, transparent financial records and avoid unethical or unlawful financial activities that damage stakeholders or customers. Cybersecurity Compliance: Cybersecurity rules involve encryption, firewall security, network controls, breach prevention, and remediation to protect IT data. Health Insurance Portability and Accountability Act (HIPAA) rules, FedRAMP standards, and PCI DSS are just a few examples of many current regulations that contain cybersecurity obligations. Regulatory Compliance: This unique compliance stresses an organization’s legal requirements. Legislation and monitoring from a government or regulatory agency support regulations. The others may overlap with this rule. Financial, IT, reporting, and audit tracking are often required for compliance. Because rules overlap, it’s important to know where they come from. According to federal and state laws, all healthcare providers, insurance companies, and suppliers must comply with HIPAA. However, HIPAA includes cybersecurity and financial protection security.How to Choosing the right invoicing method

Many things should be considered before choosing the right invoicing method. These include the company’s size, the complexity of its billing requirements, and its budget. Before choosing a billing system, businesses should think about a number of things. Considerations like as price, scalability, simplicity of use, and vendor support are important. When looking for a billing system, businesses should keep in mind that simplicity, accuracy, and efficiency should be their top priorities. In any case, this has to be the primary concern. A well-designed billing system contributes to the success and growth of an organization by cutting costs, improving customer satisfaction, and minimizing labor. Also Read: Choosing The Right GST Billing Software: A Comparative ReviewConclusion

The benefits of automated invoicing for your company are now clear. An intelligent step toward increasing profits and laying the foundation for growth is establishing an automated system for processing invoices. What are you waiting for? Now is the time to begin enjoying the GST billing software advantages with Invoice Processing Automation. Contact us right away to talk about managing your billing. Whatever problems your company is experiencing, we at CaptainBiz can help you in finding a solution.FAQs

-

Why do you need GST billing software?

-

Why is GST billing software better than sending invoices by hand?

-

What makes GST billing software successful?

-

Why is automated billing beneficial?

-

What should businesses think about when choosing a way to bill?

-

Does using GST billing tools make you safer?

-

How can GST billing software help tax compliance?

-

What benefits does GST billing software provide in real-time tracking?

-

How does GST billing software help you follow the rules for taxes?

-

Does GST billing software allow remote access?

See why GST billing software outperforms manual invoicing in accuracy and speed.

Shraddha Vaviya

Content Writer

With several years of experience, I am deeply passionate about writing and enjoy creating content on topics such as GST, tax and various finance-related subjects. My goal is to make complex financial matters understandable for readers by simplifying them.