How Custom App Development Can Support Your Business ?

Custom app development has emerged as an effective tool for businesses. With over 8.93 million apps available globally, it has become harder for any business

Custom app development has emerged as an effective tool for businesses. With over 8.93 million apps available globally, it has become harder for any business

The other day, while I was shopping for clothes online, I got stuck trying to figure out the sizing chart. It was really frustrating, and

A standard pay cycle manages the timely payment of salary to the employees. But whenever it fails, companies look after the substitute called the off-cycle

Reaching your audience through their preferred channels is a popular and effective marketing strategy. However, this is only one aspect of marketing. To succeed in

A lot of people often donate to charities considering the moral value and deeds. However, it is important to note that donating money can also

Several startups and established businesses in India face severe challenges when they have to deal with paperwork. The manual paper operations will hamper their daily

Nowadays, many business leaders look at the challenges ahead- the productivity issue, ongoing inflation, slower economic development, and many more – and immediately search for

Imagine you’re running your online store on a hectic Friday evening. You are constantly receiving orders, but so are the questions: “Do you have this?”

In today’s digital world, personal information is constantly shared online, making it more important than ever to protect it. Whether you’re shopping online, using social

The digital world has grown significantly over the past ten years. Millions of individuals choose to shop online these days on e-commerce sites. However, selling

Introduction Rubber and rubber articles consist of every hard, soft, vulcanized, and non-vulcanized product made of rubber. Common types of rubber materials are natural rubber,

Introduction Planning taxes can be intricate because of the huge number of deductions and exemptions available for use. Although a great many people know all

Introduction Section 80DD is designed especially for those people who are facing personal challenges in their life. For providing with the required support in order

Introduction Knowing how to save taxes is pivotal for senior citizens who rely vigorously upon their savings and investments. Section 80TTB of Income Tax Act

Introduction Sections 80C, 80D, and 24 are the usual suspects when it comes to income tax deductions (b). But have you ever dug into the

In the business world we live in today, all activities must be performed in the shortest time possible, and even more so, cut down costs.

Billing consists of issuing invoices to strictly defined customers for goods or services rendered and is a critical activity in sustaining a business’s operating cash

Introduction For those burdened with education loans, Section 80E of the Income Tax Act offers a valuable deduction on the interest paid, easing financial pressure.

Introduction Section 80EEA is an attachment or a corresponding insertion in the Income Tax Act 1961. This section allows home loan borrowers to get additional

Introduction Section 80EE Income Tax Deduction helps new buyers to buy a home. If you need help with your income tax deductions. With Section 80EE,

Introduction Every taxpayer in India, while filling out ITR, looks for different ways to deduct as much as possible by showing investment and other ways.

Introduction If you have been a regular donor for any charity purpose and are looking for a deduction, then the Income Tax Act 1951 offers

Introduction Introduction: Here is the news: If you are under the impression that the interest you are saving in your bank account will yield more

For Indian taxpayers, the process of Tax Deducted at Source on a GST Bill is a crucial step. Understanding the steps and following the guidelines

Maintaining good financial awareness is crucial in today’s hectic workplace. Systems that are smarter and work better than the old way of doing accounts by

In today’s hectic work environment, your success may be much enhanced with the correct tools. Ledger accounting software is one instrument that may significantly influence

Effective inventory management is essential for small business owners working with batch-wise inventory. A good inventory management system is more important now than ever in

In logistics and supply chain management, ensuring goods move legally and run smoothly is very important. The E-Way Bill system, implemented as part of GST,

Proper paperwork is essential for keeping things clear and ensuring business runs smoothly. The Proforma invoice and account sales are two important papers that often

Among the most critical changes to Indian taxes is the Goods and Services Tax. The GST structure has replaced multiple secondary levies with a single

Introduction The Goods and Service Tax system has refined today’s taxation system in India. It has unified all taxes for diverse goods and services. On

Introduction The launch of Goods and Services Tax in India in July 2017 has mandated every company, partnership business, or proprietor to file their tax

Starting on July 1, 2017, the Goods and Services Tax has been among the most important tax revisions India has undergone. It took the place

In India, the Goods and Services Tax (GST) has introduced a range of tax rates for pharmaceutical products. However, not all medicines are subject to

Every start to anything new is tough, and starting a business is no exception. It brings immense satisfaction to be your boss, but also a

Medical equipment is essential in the healthcare industry for accurate diagnoses and effective treatments. As India’s Goods and Services Tax (GST) regime evolves, understanding the

Understanding capital gains tax can be challenging, especially for small business owners juggling multiple responsibilities. However, delving into this topic can provide valuable insights. By

Starting and managing a small business in India can be an exhilarating journey, full of opportunities and challenges. One of the most critical aspects of

Having a good online presence is essential for any organisation in the modern digital age, regardless of whether it is in the manufacturing or service

Introduction Chartered Accountancy (CA) firms play an essential role in the complex economic structure of India by integrating transparency, integrity, and strategic foresight into the

Tax planning is critically important for your financial well-being as a high-net-worth individual (HNI). Managing taxes becomes increasingly complex with higher incomes, and it’s a

India is a hub for chartered accountants (CAs) and the financial sector. With four lakh CA members registered under the Institute of Chartered Accountants of

As a business owner, you are continuously juggling multiple tasks, strategising for growth, and reviewing your finances. Among all of these tasks, understanding your company’s

Making the decision to start a CA practice after assessing your options for a job or practice can be intimidating. And the next important decision

The number of entrepreneurs in India has increased significantly in recent years. These individuals are working hard to build enterprises from the ground up and

Introduction In India, entrepreneurship is fully in the air. Over the last ten years, there has been a massive increase in the creation and funding

Budgeting is crucial in managing any business, especially for small business owners. By setting up an extensive budget, you can ensure your business stays on

Introduction Owning a small business requires multitasking, from managing operations to delivering exceptional customer service. And this does not come easy. Between these responsibilities, navigating

Starting a business is not an easy task. And managing one is an even tougher task. As a founder, we have so many responsibilities to

When we talk about personal branding, it is about showcasing who you are. Your business will come next, but who you are and what your

Introduction In today’s digital world, any professional, including chartered accountants (CAs), must stand out. However, CAs face a unique challenge in advertising because the Institute

Tax season is here, and with it comes the annual routine of filing income tax returns. This may seem like a lot of work to

Running a business has its share of rewards, however, there are various challenges involved, especially in the subject of taxation. Even when your bottom line

Starting a business is similar to laying the foundation of a building. To ensure that the base is strong, each step needs to be meticulously

This is very important question indeed in present times. In today’s rapidly changing world, one of the most prominent questions is whether artificial intelligence (AI)

The world of AI is evolving with each passing day, and so are businesses. And with that, chartered accountants, too, are not left behind. As

There is an entrepreneur within each of us, and most of us want to build something of our own someday. When you start your entrepreneurial

Odisha’s robust business environment and support services are helping attract more people to start businesses. Whether you wish to launch a small or large firm,

Many people find the probate procedure unsettling. Those who have lately lost a loved one may find it difficult. Knowing the processes required to apply

Understanding Billing Data and Business Intelligence (BI) The financial data produced by transactions, invoices, and billing procedures inside a company is called billing data. This

Introduction In finance and accounting, billing software is a cornerstone for businesses, ensuring efficient transaction recording and compliance with tax regulations. Desktop billing software is

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

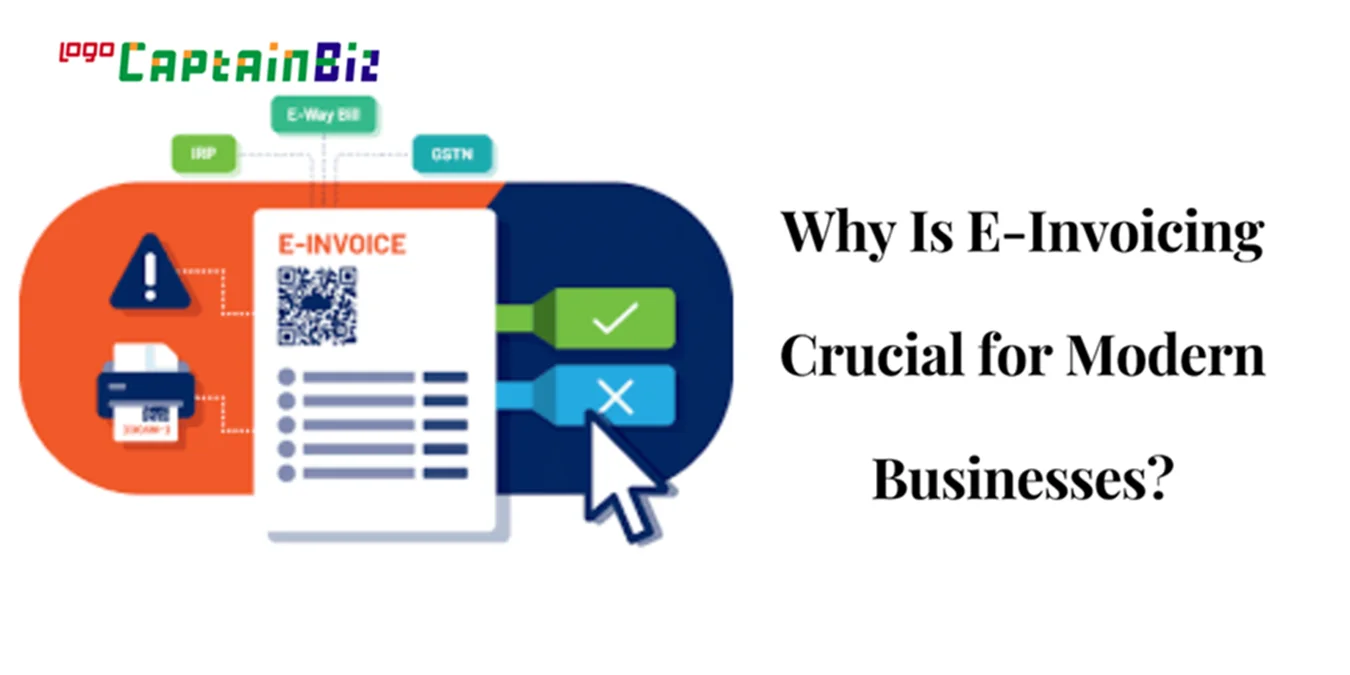

In today’s world where everything seems to be speeding up, organizations have to run a fast race to keep pace. Thus, issuing e-invoices is where

Hello, fellow business explorer. If you’re looking for a GST software that will help you handle your finances more efficiently or more smoothly, you are

Any business owner that trades in goods and services within the territories of India has to obtain a GST Registration, if they fulfill the eligibility

ओळख चलन म्हणजे व्यावसायिक साधन आहे जे विक्रेता खरेदीदाराला पाठवतो. यात व्यापारी पक्ष, माल, वस्तू, मूल्य, पाठवण्याची तारीख, वाहतूक साधन, सवलत आणि इतर देयरक्कम तसेच

The ever-changing environment of modern business provides a perfect scenario for efficiency to be the pillar of success. It doesn’t matter if you are a

The chase for obtaining outstanding payments from clients is very common among business owners. However, did you know that even those minute follow ups can

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The HSN code is a global system for classifying products. It uses numbers and names to categorize goods. These codes help with taxes, customs, and

The E-Way bill is now one of the most essential tools for ensuring things can quickly move between Indian states. But recent events make it

Introduction to GST and its Implications for Businesses As its name suggests, the Goods and Services Tax in India is an indirect tax system levied

In today’s business environment, where accountability and enforcement are serious issues, accurate financial reporting is a critical pillar for informed decisions and regulatory compliance. The

Form 10BA is the most essential requirement to claim the house rent deduction under Section 80GG. However, you must not be receiving HRA (House Rent

Introduction to Cloud-Based Solutions What is Cloud-Based Billing Software? In the ever-evolving landscape of business technology, cloud-based billing software has emerged as a game-changer. This

© Copyright CaptainBiz. All Rights Reserved