1. Calculating GST liability for supplies

Compared to the old Service Tax Calculation or VAT calculation, there are many changes in the GST liability calculation. Here are the following points you need to follow to finalize the GST liability for any month –-

Step 1 –

First, you need to prepare a loss account and draft the profit for the month when you calculate the GST. Additionally, you should account for all the income or sales, as well as the expenses. -

Step 2 –

The profit’s debit side and the loss account need to be checked. Additionally, you must search for services or purchases from unregistered suppliers or dealers. If there are any, you must pay the GST for those services or purchases.

The system categorizes these types of inward supplies and purchases under reverse charge provisions. Furthermore, you need to ensure that you have paid all the reverse charges for the services or purchases taken from even the registered suppliers or dealers.

-

Step 3 –

Take account of any advance you receive or pay when the bills remain unpaid. You need to clear GST payments on those advances, too. -

Step 4 –

After completing all the above steps, you will calculate your gross GST liability by adding GST on outward supply, GST on reverse charge, and GST on advances received during that specific month. -

Step 5 –

Now, the Gross GST Liability you got by counting everything in Step 4; you need to subtract it from the Input Tax Credit added with GST paid on Reverse Charge. -

Step 6 –

The number you will get at the end of step 5 will be the NET GST Liability. -

Step 7 –

You must determine whether you possess any TCS or TDS Credit to pay the NET GST Liability Check. If you have the TCS or TDS Credit, you can also deduct them. -

Step 8 –

After completing the calculation till Step 7, the number you acquire is the money you need to pay by challan in the Bank.

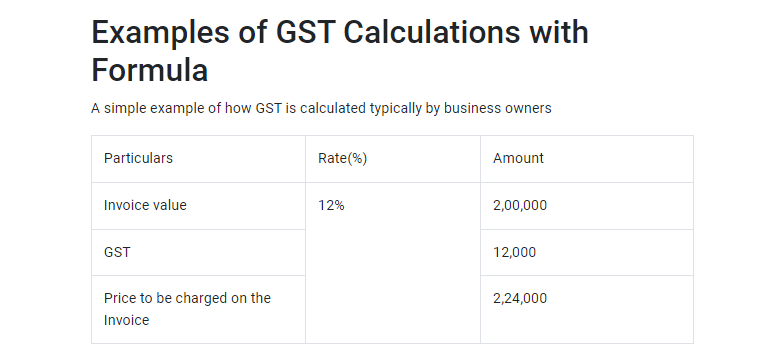

2. Business and individual GST computation methods

Here is a simple method of calculating GST – For example, if a product or a service is sold at 5000 rs and the applicable rate of GST is 5%, then the net price will be calculated as = 5000 + (5000x (5/100)) = 5000 + 250 = 5250 rs. Here is the basic GST formula to calculate GST – When calculating the tax applicable to a specific good or product, the process becomes much simpler when the indirect taxation regime is simplified. Businesses calculate GST on goods and services based on the nature of the supply (interstate or intrastate) using applicable GST rates. Here is how to calculate GST for Intra-state supplies –- CGST – GST rate applicable / 2 (for 18%, CGST will be 18/2 = 9%)

- UTGST or SGST – GST rate applicable / 2 (for 18%, UTGST or SGST will be 18/2 = 9%)

- Original Cost = GST inclusive price x GST rate / (100 + GST rate %)

- GST Amount = GST inclusive price x 100 / (100 + GST rate %)

3. Determining GST liability for various supplies

The supplies that come under the GST liability include the supply of goods and services such as — money transfer, sale, rental, exchange, lease, disposal, license, and barter. Regarding liabilities regarding GST, one needs to heed whether the import of services is in the course of business. Taxpayers determine the taxability of goods and services and identify the total tax payable as liabilities. Aspects like the place of supply, time of supply, and location of supply also play a massive role in determining the GST liability for the various supplies.4. GST calculation procedures for businesses

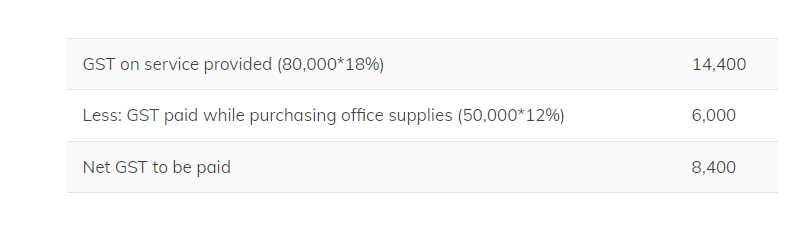

Any business with a turnover exceeding 40 lakh rs in one financial year must register under GST. For service providers, the threshold is 20 lakh rs a financial year. After GST implementation, businesses can purchase 50,000 rs worth of supplies at the GST rate of 12% and provide a service to a different company for 80,000 rs at the GST rate of 18. In this case, they can relish the tax credits paid on purchases after GST implementation. The following calculations determine the tax liability:

5. Individual GST liability assessment for supplies

The calculations for determining tax liability under GST law follow a structured process known as Assessment. Here are some of the assessments under GST —- Self-assessment

- Provisional assessment

- Summary assessment

- Scrutiny assessment

- Assessment of unregistered persons

- Assessment of non-filers of returns

- Best judgment assessment

6. Guidelines for accurate GST liability calculation

The guidelines for the accurate GST liability calculation are the steps following, which will allow you to get an accurate GST amount that you are responsible for paying to the government of India. The steps mentioned earlier in the article, where we discussed calculating GST liabilities, are: You need to be familiar with the GST rates that influence the GST liability calculation. Under the GST law, you can find 7 specified rates that apply to the goods. In the GST Rates Booklet for Goods, all of these rates are classified under “Schedule” and they are —| Schedule I | Nil Rated |

| Schedule II | 0.25% |

| Schedule III | 3% |

| Schedule IV | 5% |

| Schedule V | 12% |

| Schedule VI | 18% |

| Schedule VII | 28% |

| Schedule I | Nil Rated |

| Schedule II | 5% |

| Schedule III | 12% |

| Schedule IV | 18% |

| Schedule V | 28% |

Conclusion

GST is the indirect tax implemented by the Government of India and needs to be paid by every taxable person for the supply of goods and services. The businesses and the individual both have to pay taxes based on the nature of their supply, and both of them can calculate their GST amount either with the help of the formula explained above or with the help of a GST calculator. Also Listen: Calculate Your GST within SecondsFAQs

-

What does the GST inclusive amount mean?

-

What does the GST exclusive amount mean?

-

What is the current rate of GST in India?

-

How are the advance GST payments calculated?

-

How to calculate the discount price GST?

-

How to calculate composite supply GST?

-

Are international transactions susceptible to the GST calculator?

No, international payments do not include a GST amount calculated in the GST calculator. Since GST is a tax levied by the Indian government, it applies only to domestic transactions.

-

Do you have to use a GST calculator when calculating GST?

-

Can you use the GST calculator for Multiple GST rates?

-

Does every good and service get charged with GST?

Accurately determine GST on supplies and ensure compliance using CaptainBiz tools.