Impact of GST errors on businesses: In the past, taxpayers may have fixed mistakes on their Service Tax and VAT files. On the other hand, there is currently no way to change or update a GST return after it has been submitted. A revised procedure for modifying GST returns is in the works but has not yet taken effect. A taxpayer cannot change their returns until that has occurred. So, he has to be very careful when submitting his GST returns so he doesn’t have to deal with the hassle of unnecessary reconciliations. Businesses operating under the Goods and Services Tax (GST) system must thoroughly understand the Input Tax Credit rules and eligibility. A thorough understanding of these regulations matters to correct mistakes and claim credits. Businesses must ensure accuracy, compliance, and avoidance of possible financial penalties by implementing best practices and avoiding common mistakes in GST filing.

What is GST Return?

Any company registered for the Goods and Services Tax (GST) system must file a GST return regularly with the relevant authorities. It is a record detailing a taxpayer’s financial transactions, including sales, purchases, taxes paid, and tax credits claimed. In order to aid in tax assessment and collection, taxpayers are required to file GST returns.How Does a GST Calculator Work?

You can easily use the GST Calculator. You may use this to determine how much GST you must pay each month or quarter. Wholesalers, manufacturers, and others frequently employ it. The main points are these:- Businesses and individuals may use it to figure out their GST.

- It requires you to input your transaction data before you can utilize it. This includes the cost of the product or service itself, the relevant GST rate, and any extra charges for such delivery or insurance.

- When the GST calculator has all the necessary data, it will determine the GST amount and the overall transaction value.

- It may be helpful for quickly and accurately calculating GST.

- Furthermore, it reduces the probability of GST computation mistakes. So, it helps stay out of trouble with the law and avoid fines.

Who must submit a GST return?

Returns for the Goods and Services Tax (GST) are required of all individuals and entities registered for GST. Everything that follows is part of this:- Firms, individuals, limited liability partnerships (LLPs), and Pvt ltd companies are all part of the supply chain.

- Any company that makes regular taxable supplies or qualifies for a composition plan must submit GST returns. GST-registered companies that aren’t making any money throughout the reporting period must submit no reports.

Procedures to calculate GST using an Internet tool

- Try to find a website that offers a GST calculator.

- You may pick between an option that includes GST and one that does not, depending on your requirements.

- After that, you’ll need to total up the amount of the item you bought.

- Choose the GST rate that fits your products.

- To see the final amount, click the “calculate” button.

Advantages of GST Calculators

- Reduces calculating mistakes.

- Avoiding unnecessary expenditure of time and effort is beneficial.

- It is helpful to calculate gross or net product prices using percentage GST rates.

- Additionally, a GST calculator simplifies calculating the Integrated Goods and Services Tax.

- Businesses may use a GST calculator to stay out of tax trouble.

Common GST Calculation Errors

The impact of GST errors on businesses can be significant, leading to financial, operational, and reputational challenges.Miscalculation of Taxes

Incorrect tax calculations are among the most prevalent GST mistakes. Companies make this error when they either don’t know or incorrectly calculate the GST rate that applies to their goods and services. This may result in financial fines and penalties. Businesses can stay ahead of the game by understanding which GST rates apply to their goods and services and then using an accurate GST calculator to figure out how much tax to pay.GST Filing Noncompliance

Another common GST mistake is failing to file returns that comply with the applicable requirements. Businesses must submit GST returns on a monthly, quarterly, or annual basis, depending on their annual turnover. Submitting returns late or with incorrect data could lead to financial penalties. Avoid fines by making sure your business complies with all GST filing requirements and has proper records.Decision to Retain Input Tax Credit

Businesses may claim a tax credit for taxes paid on purchases made for their operations, known as input tax credit (ITC). The input tax credit (ITC) allows businesses to lower their GST bill. You can’t get your ITC claim back if the company spends the money for personal use or the vendor doesn’t pay their share of taxes. Penalties and fines may result from failing to reverse ITC. Businesses must keep proper records and reverse ITC appropriately.Errors in Electronic Invoicing

Failure to Generate Required Electronic Invoices: This requirement has been in place since 2020 for companies with a yearly revenue of more than 50 crore rupees. There are fines and penalties for not using electronic invoicing. In order to stay out of fines, businesses should be sure to issue electronic invoices and keep proper records. Due to GST, businesses in India now face less complicated taxes, but there is a trade-off: more oversight and tougher compliance requirements. Businesses face severe penalties if they fail to conform to the many rules and regulations of the GST system. The following are examples of some of the most typical GST mistakes.Inaccurate Tax Billing

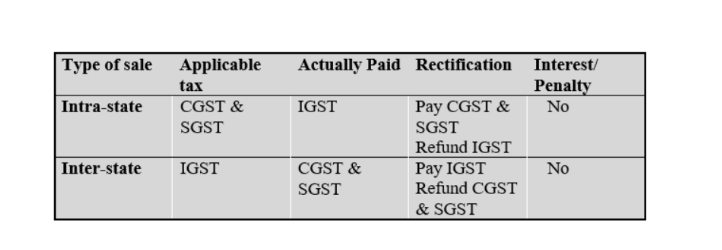

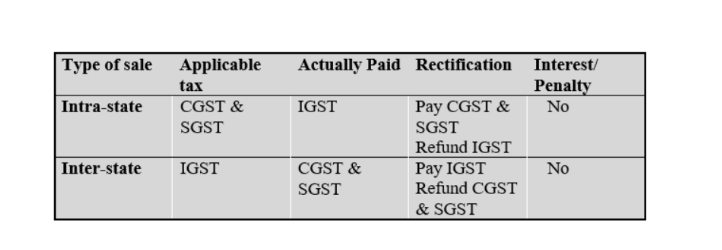

Businesses are required to provide invoices that follow GST standards to avoid incorrect tax invoicing. There may be fines and penalties for failing to provide an invoice and issuing an incorrect one. For goods and services tax (GST) invoices to be valid, they must include the following details: the date of the invoice, the supplier’s and recipient’s GST numbers, a description of the products or services, and the total amount of tax. It is critical for businesses to produce precise invoices and keep detailed records.When there is an error in the collection and deposit of taxes with either the federal or state government

No is the simplest way to put it. Let’s take a close look at the different possibilities.

What are the GST calculation best practices?

Make sure you have an understanding of the GST laws and regulations that apply to your locality. There may be regional and even national variations in GST rates and regulations. Businesses must ensure accurate GST (Goods and Services Tax) calculations to avoid penalties and stay in compliance with tax laws. If you want GST calculation best practices for precise results, try these strategies.Make sure all records are accurate.

You must properly document and store all of your company’s financial dealings, including purchases, sales, expenditures, and GST received or paid.Using an Accounting Software

Think about using GST-compliant accounting software. Errors are far less probable to occur because many accounting software programs automate GST calculations.Keep Records Up-to-Date

Check the GST returns you’ve filed against your records on a regular basis. Doing so can aid in the detection of errors and the verification that your records are consistent with your tax filings.Keep Taxable and Non-Taxable Supplies Separate

Differentiate between supplies that are taxable and those that are not. The Goods and Services Tax (GST) does not apply to everything, and incorrect categorization can cause problems.Be Careful with ITCs

It is imperative that businesses correctly claim their Input Tax Credits (ITCs). With input tax credits, you can get back some of the GST you paid on company spending. As proof, hold on to invoices and receipts.Confirm Accurate GST Calculation

You can usually find the GST amount by multiplying the GST rate by the sale price and then dividing the result by 100. Verify that you’re charging the right GST rate on all purchases. Also Read: GST Calculation Formula: A Comprehensive Guide For Sales And PurchasesGST Audit benefits for businesses

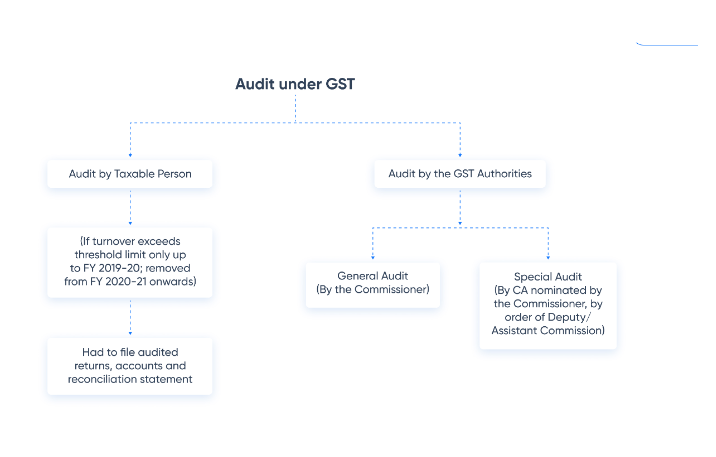

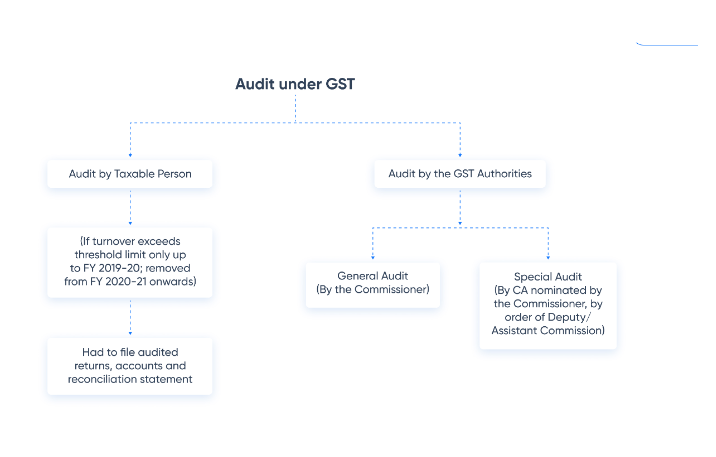

GST audit benefits for businesses include a thorough examination of a registered dealer’s records, ensuring compliance with GST regulations. The process of auditing a registered dealer’s records is known as an audit under GST. In order to determine if a business is in compliance with GST, it is necessary to verify that all tax payments and declarations are accurate.

Importance of Regular GST Audits

- A GST audit is required to verify that businesses follow GST rules.

- An audit is conducted to make sure GST is paid on time, and all transactions are recorded correctly.

- Also, it’s helpful in finding places where companies can enhance the way they operate to make more money.

- Also, it helps in the detection of financial irregularities and fraudulent activities, which can help a business save money and avoid problems down the line.

Avoiding common mistakes in GST filing

Take your time and carefully complete all of the forms.

No need to start crossing things off a list while you’re in the middle of a meeting or eating lunch; instead, set aside dedicated time to complete the forms. Consider devoting a few hours to this task, mainly if this is your first or second reporting. Put everything else aside and concentrate on what you’re doing. Get all the data and figures you’ll need up and running.Verify every important detail carefully.

The easiest parts to fill in are also the most likely to include mistakes. Make sure to verify the following:- Your company’s name

- Company Number

- How is your company organized?

- Your name and contact info

Verify your financial records

Not every business owner is naturally good at keeping records. Be careful you have the following correct if you are lodging reports independently;- Selling and buying should match the accounting period.

- Verify that you handle your accounting in the correct way. Different types of businesses and industries are subject to different GST calculations. To find out how to calculate your GST correctly, look here.

- Do you have an installment plan? How often do you file monthly, quarterly, or once a year? Verify that you have done the calculations correctly.

- If you want to be sure the numbers are correct, reset the calculations.

Be familiar with basic concepts

Even a small error may make your report ineffective, requiring a re-submission of your GST. There will be additional paperwork and calculations to complete. The basics of filing paper returns: In order to stay up to date with tax requirements and avoid significant mistakes while completing GST returns, companies have to verify that their GST calculations and returns are accurate. Businesses may confidently handle the complexity of GST by learning the regulations, keeping excellent records, and getting expert advice. Also Read: Top 10 GST Filing Mistakes to Avoid in 2024Looking for Expert Help

Getting expert advice is necessary for avoiding common mistakes in GST filing. Experts know their way around complicated tax regulations, can guarantee precise computations, and can get things done quickly. Misclassifications, incorrect computations, or missed deadlines are some of the many problems that they might help businesses spot. Hiring professionals reduces the chance of costly penalties and audits, giving company owners comfort and freeing them up to concentrate on what they do best. When it comes to GST, where mistakes in submitting returns may cost a lot of money, having expert advice is a must for staying in compliance and keeping your finances stable.Wrapping It Up

Being precise is of the greatest value while dealing with GST. You can make sure that your GST filing goes smoothly and according to plan by learning about and fixing these common errors. The keys to success in the ever-changing world of taxes include being careful, getting qualified advice when necessary, and keeping up with changes in GST calculation best practices & GST regulations. Also Listen: GSTR Filing Process with CaptainBiz – TutorialsFAQs

-

How does one use a GST calculator to figure out GST?

-

What happens if you make a GST mistake?

-

How can companies keep away from GST errors?

-

If a company makes a GST mistake, what should they do?

-

How do I fix GST errors?

-

Are refunds available to businesses in the event of GST errors?

-

How can companies make sure they are complying with regulations regarding electronic invoicing?

-

What should businesses do for GST compliance recordkeeping?

-

Why is GST audit important?

-

Is it essential for all businesses to undergo a GST audit?

-

Can businesses claim Input Tax Credit (ITC) for purchases made for both business and personal use?

Minimize GST calculation errors with smart tools and stay audit-ready.

Shraddha Vaviya

Content Writer

With several years of experience, I am deeply passionate about writing and enjoy creating content on topics such as GST, tax and various finance-related subjects. My goal is to make complex financial matters understandable for readers by simplifying them.